01020304

The Current State of Cryptocurrency: Bearish or Bullish?

2024-09-12

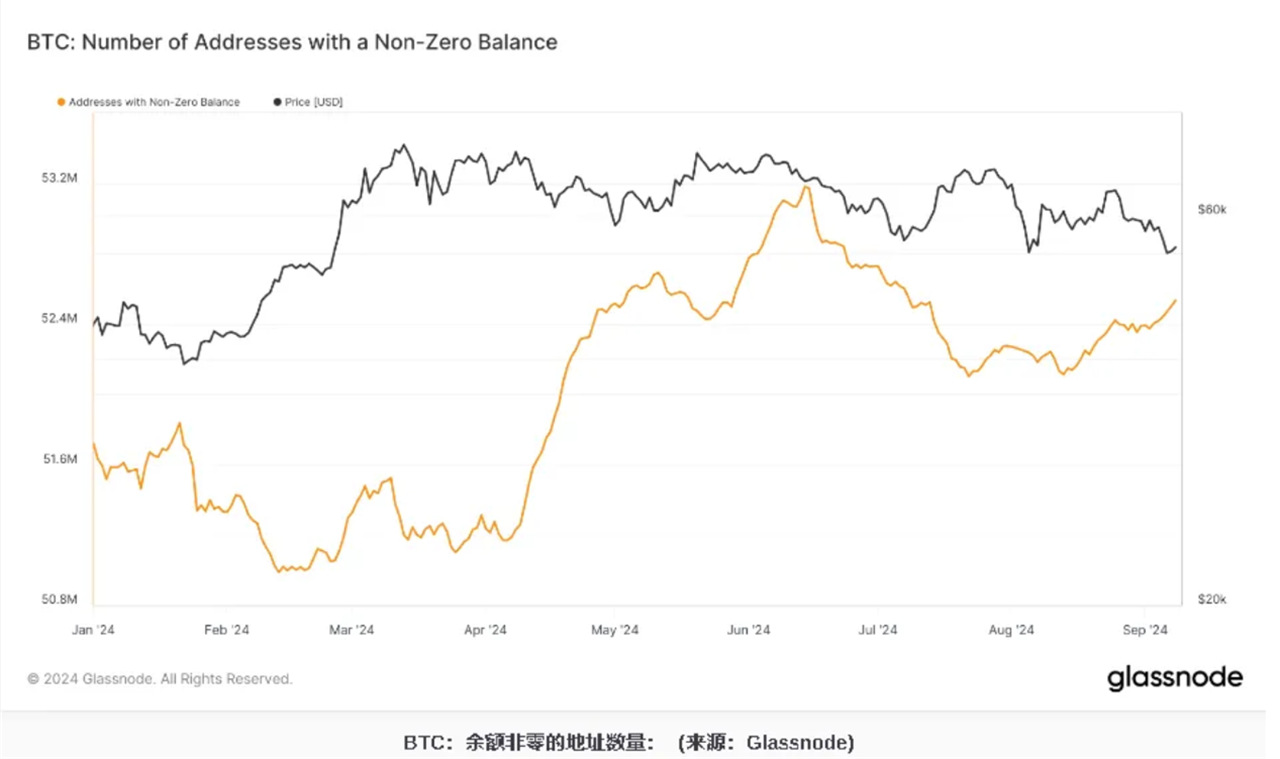

The number of Bitcoin non-zero balance addresses has been growing steadily in 2024. After a dip in early January, the total number of unique addresses began to recover around March and grew significantly from May to September — now close to 53.2 million.

User activity has remained on the rise despite price volatility (it has fallen from around $70,000 to below $60,000 since March).

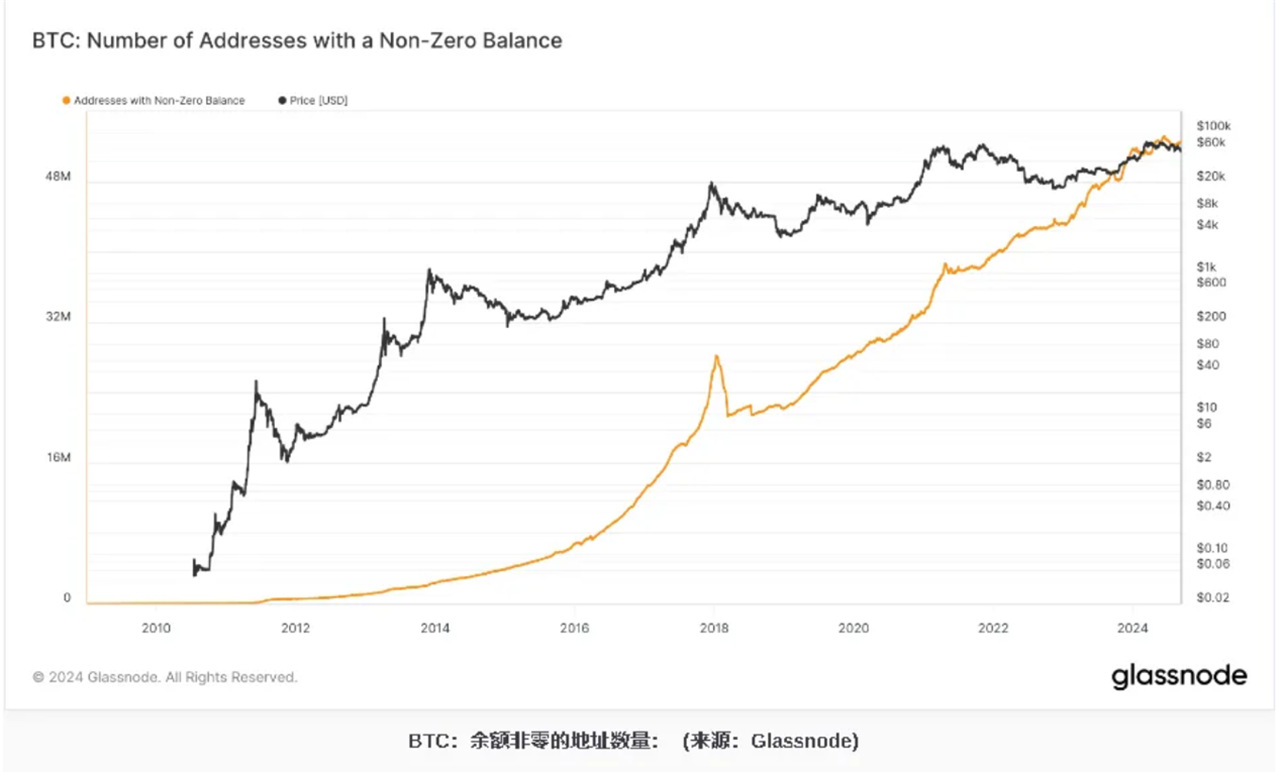

Historically, this metric has shown consistent growth, reflecting long-term adoption trends.

As shown in the second chart, the number of non-zero addresses has been trending upward since 2010, with only brief dips during major market corrections, such as the 2018 bear market. The continued growth in 2024 is consistent with broader market patterns following the Bitcoin halving event in April.

Understanding the current state of the market through data charts

Here are some data points to help us understand the current market conditions:

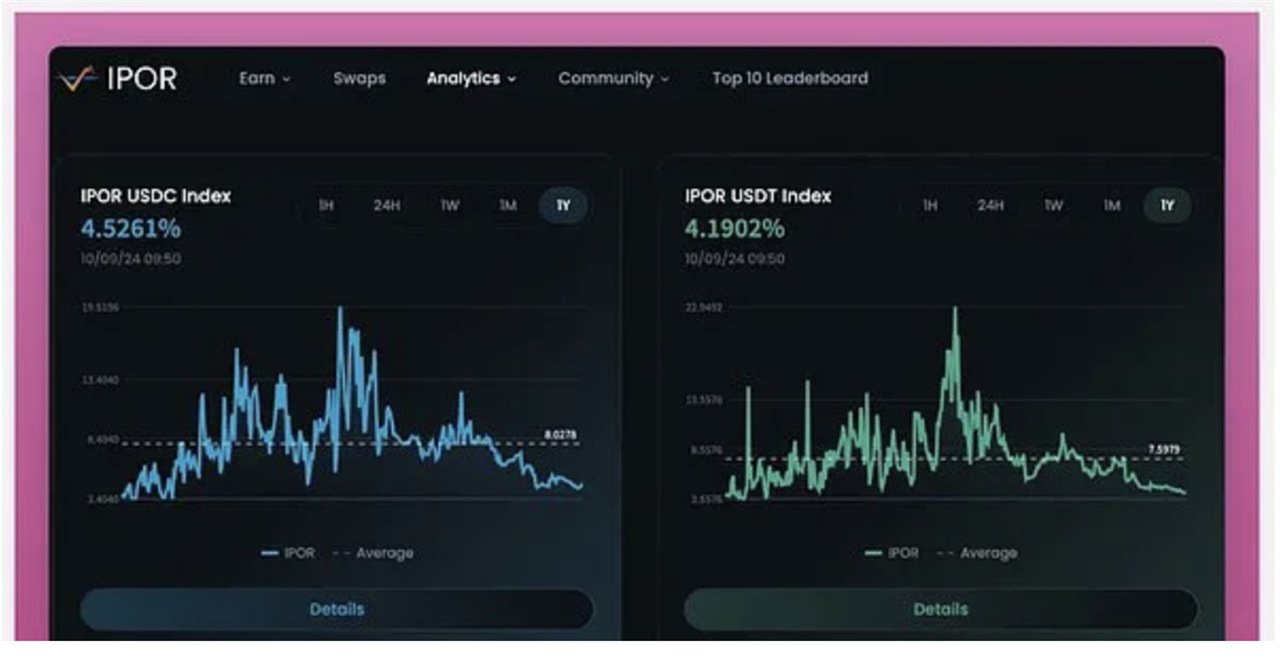

IPOR Stablecoin Index: Data shows that on-chain leverage has dissipated and lending rates are back to pre-2023 rally levels. During the airdrop farming period, lending rates spiked, but farmers closed their circular positions due to poor airdrop results.

BTC Open Interest: BTC open interest shows that leverage has also reset. Funding rates were higher in March, but turned negative in April and July/August, meaning shorts paid longs, indicating that traders expected the market to fall. However, open interest (OI) is currently positive again.

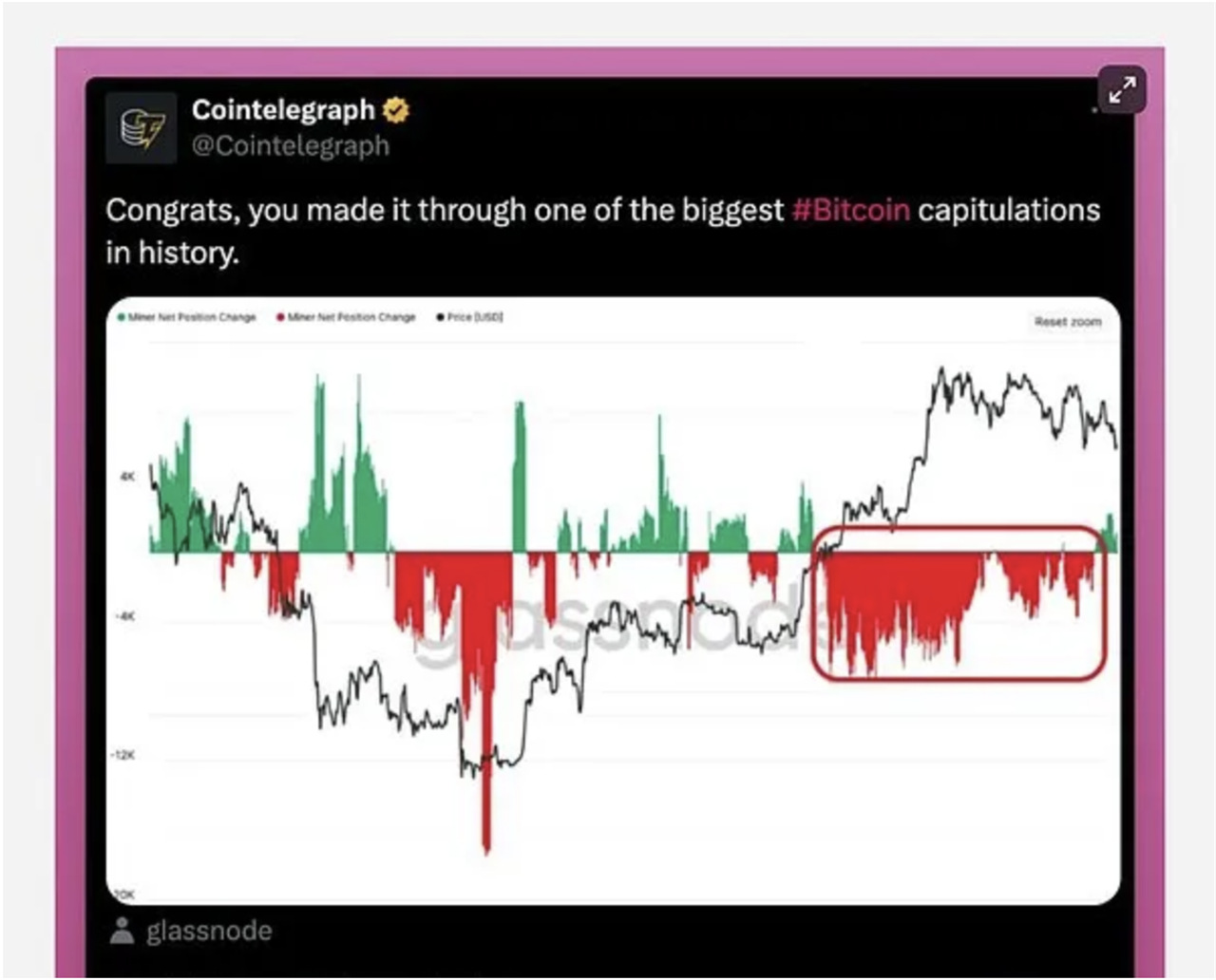

Miner Selling: Another bullish indicator iS Miner selling behavior. Miners seem to have stopped selling and have started accumulating BTC again.

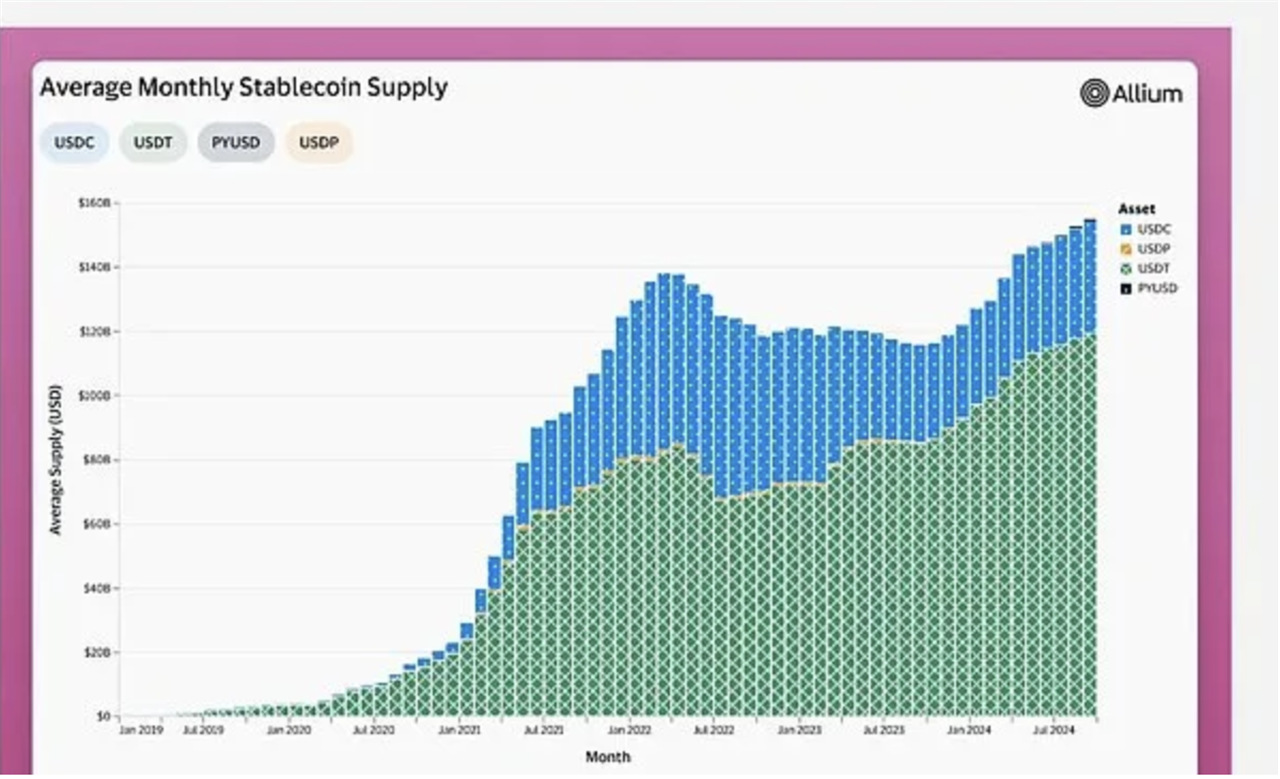

Stablecoin Supply: The continued growth of stablecoin supply may be a more bullish chart.

Total supply is rising, but the difference is that USDT supply has increased while USDC has shrunk from $55 billion to $34 billion. Why?

First, the Silicon Valley Bank collapse caused USDC to decouple, marking the apex of USDC supply. Another possible explanation is that US policies, as suggested by Nic Carter, pushed investors into less regulated offshore stablecoins, so USDC growth stagnated while USDT continued to expand.

If that’s the case, then crypto-friendly US regulation could be a bullish catalyst for USDC to rise… oh wait…

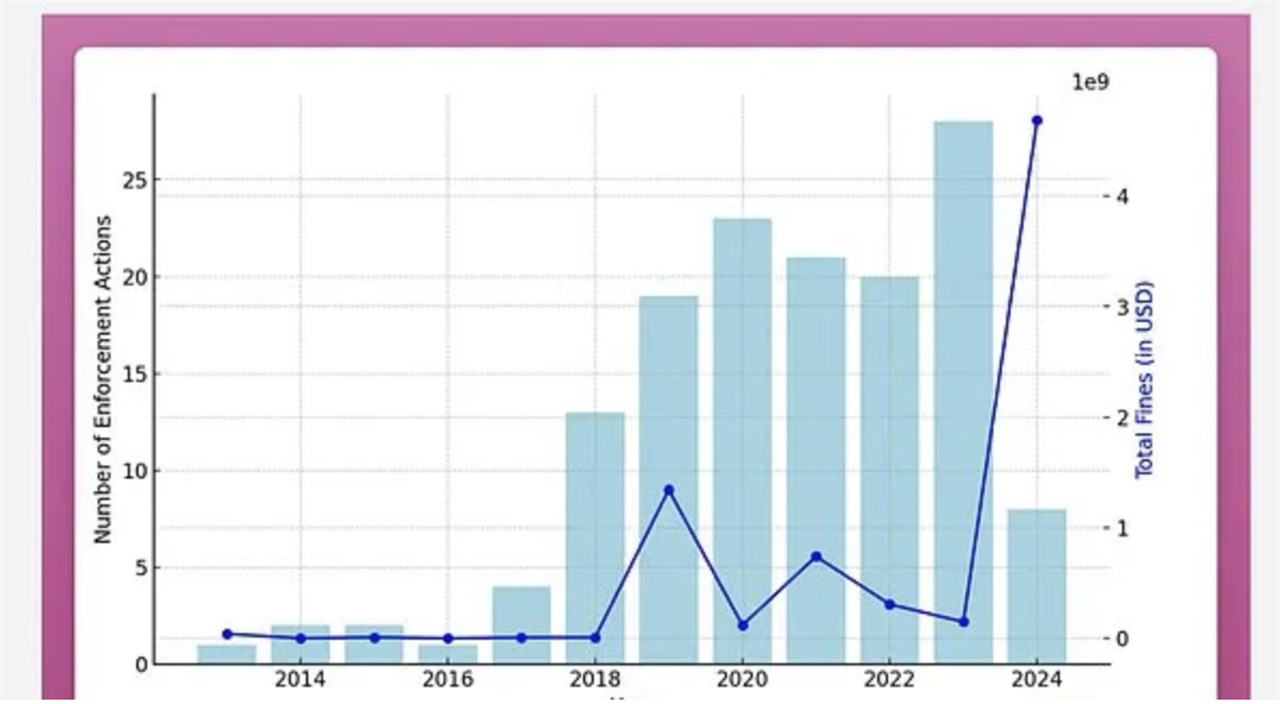

Regulatory: In 2024, the US SEC collected $4.7 billion in fines from crypto companies, a 30x increase from 2023.

This money, which should have been invested in the crypto space, ended up in the hands of government bureaucrats rather than actual victims in the crypto space.

The largest portion of this was the $4.47 billion settlement with Terra. The good news is that according to the Social Capital report, the SEC is shifting toward “fewer but larger fines” with a focus on high-impact enforcement actions that have industry precedent-setting impact.

Bottom line: Up or down?

Yes, things are looking pretty bad right now.

With the ISM falling, no demand for ETH ETFs, and VCs hesitant, the market environment is not good right now. But that's how markets repair. When everyone is panicking, it usually means we are closer to the bottom than we think.

Of course, there are pessimistic data points, but there are also many reasons to be bullish. L2 is strong (especially Base), social platforms like Farcaster and OpenSocial are growing, and leverage is being cleared. Although the market heat is down, key areas remain active.

Regulation is a mess, and the SEC is squeezing the entire industry. We need to see a shift in US regulatory attitudes, or a change in leadership, to stop the market from continuing to "bleed". Crypto-friendly regulation may be a bullish trigger. Until then, the pressure remains. But remember, even if the Democrats win the election, they may need to turn on the "printing press" again to deliver on all their promises. And in this printing environment, Bitcoin is the best asset.

At the end of the day, markets don't move in a straight line. We are in that chaotic stage where emotions are shaken, and this is normal. Stay focused, pay attention to the data, and don't be distracted by the noise.