Solana Price Analysis: $180 SOL Target Possible as Meme Coin Activity Soars

Solana (SOL) has been showing impressive gains this week, trading around $154.59 after reaching an intra-day high of $156.43. The cryptocurrency market is experiencing a positive shift, with major cryptocurrencies reversing their downward trend. Bitcoin (BTC) remains strong above the $68K mark, while altcoins such as Ethereum (ETH), Solana (SOL), and XRP are also in the green. The global crypto market capitalization has risen by 0.8%, reaching $2.35 trillion.

Notably, a surge in demand for memecoins has significantly boosted Solana’s network activity and total value locked (TVL), positioning SOL for further price appreciation. If this momentum continues, SOL could realistically approach the $180 mark, fueled by rising interest and increasing trading volumes.

Solana’s Price Rises Amid Surging Network Activity and Memecoin Demand

Solana’s native token, SOL, has gained 12.1% from October 11 to October 18, currently trading at $154.52.

This rise is driven in part by increased demand for memecoins, leading to higher network volumes, fees, and a significant boost in total value locked (TVL).

However, questions remain about the sustainability of this memecoin trend, given its speculative nature.

Recent social media buzz around memecoins, such as a viral post promoting Goatseus Maximus (GOAT), which reached a $400 million market cap within a week, highlights this growing attention. This surge in activity has pushed Solana’s TVL to a two-year high of nearly 41 million SOL, marking a 13% month-over-month increase, while Ethereum’s TVL remained stagnant.

Solana also led decentralized exchange (DEX) volumes, with a 43% growth and $11.16 billion in volume, outperforming Ethereum’s layer-2 solutions. Although the future of the memecoin trend is uncertain, these metrics suggest that SOL could approach $180, supported by its strong network activity and competitive positioning in emerging sectors like AI and gaming.

Solana Price Analysis: $180 SOL Target Possible Amid Bullish Momentum

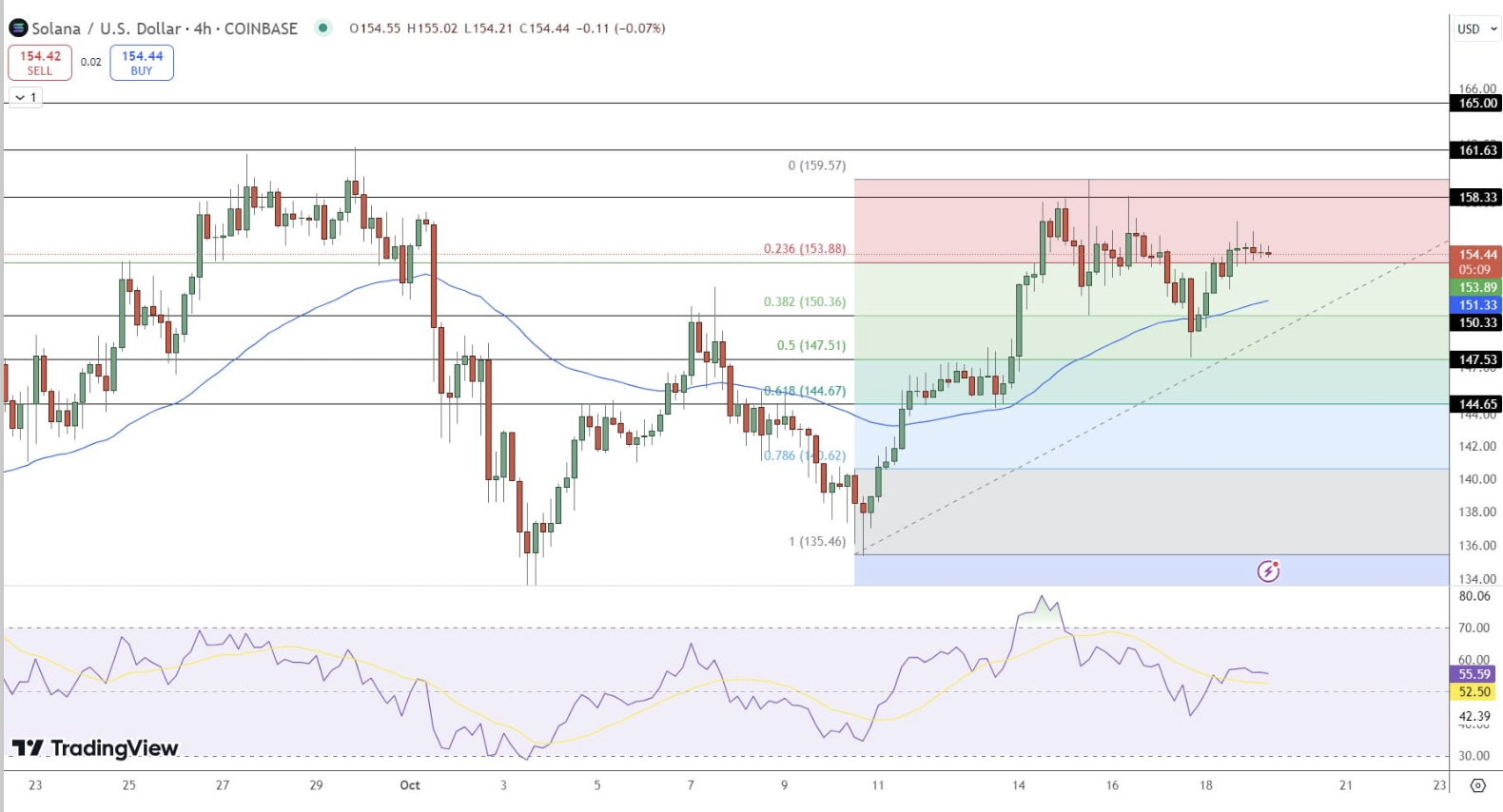

Solana (SOL) continues to show bullish signs on the 4-hour chart after rebounding from the 50% Fibonacci retracement level around $147.51, which has served as a critical pivot point.

This rebound set the stage for an upward movement, with Solana successfully surpassing the 23.6% Fibonacci retracement at $153.88, now acting as a key support zone.

If Solana fails to hold above this support, further retracement could lead the price toward the 38.2% Fibonacci level at $150.36 or back to the 50% retracement level at $147.51.

On the upside, a decisive breakout above $158.33 could pave the way for Solana to test the next major resistance at $165.

Technical indicators favor this bullish outlook. The 50-period Exponential Moving Average (EMA) at $151.33 is providing strong support, while the Relative Strength Index (RSI) stands at a healthy 55, signaling steady buying interest.

Overall, if Solana maintains its current support levels and breaks above $158.33, a broader rally toward $165 and beyond could materialize.