Bitcoin Whale Awakens After 12 Years – What’s Next for BTC Price?

In an unexpected turn, a long-dormant Bitcoin wallet containing a substantial BTC stash has become active after 12 years, stirring up discussions among crypto investors and analysts.

The wallet, inactive since 2012, made a significant move, transferring 159 BTC worth approximately $11.75 million—a transaction that highlights the wealth accumulated by early adopters of Bitcoin.

The owner purchased these coins when Bitcoin traded at a mere $10.50, now yielding a staggering profit of around 700,854%.

This development has sparked curiosity about potential impacts on the cryptocurrency market, as well as the motives behind such whale movements.

On-chain data provider Whale Alert brought this transaction to light, alongside a series of recent movements from other long-dormant wallets.

These awakenings from crypto “whales”—individuals or entities holding large amounts of Bitcoin—could have short-term implications for the BTC market, given the substantial holdings involved.

Why Are Dormant Bitcoin Whales Awakening?

Recently, several long-inactive Bitcoin wallets have reactivated, sparking curiosity and speculation within the crypto community.

Among these, a wallet holding 159 BTC (now worth $11.75 million) moved funds after 12 years, likely yielding a return of over 700,000%.

Other dormant addresses have also made transfers, with one moving 20 BTC valued at $1.46 million after 13 years and another shifting 14 BTC ($1.05 million) after 11 years.

These reactivations may stem from various motives:

- 1. Profit-Taking: High prices present a favorable moment for early adopters to cash out.

- 2. Liquidity Needs: Some whales may seek cash or diversification amid market volatility.

- 3. Security and Regulation: Concerns about regulatory changes or access to private keys might prompt activity.

These moves underscore shifts in sentiment and could lead to short-term market volatility as long-term holders re-enter the market.

Bitcoin’s Technical Outlook: Key Levels to Watch

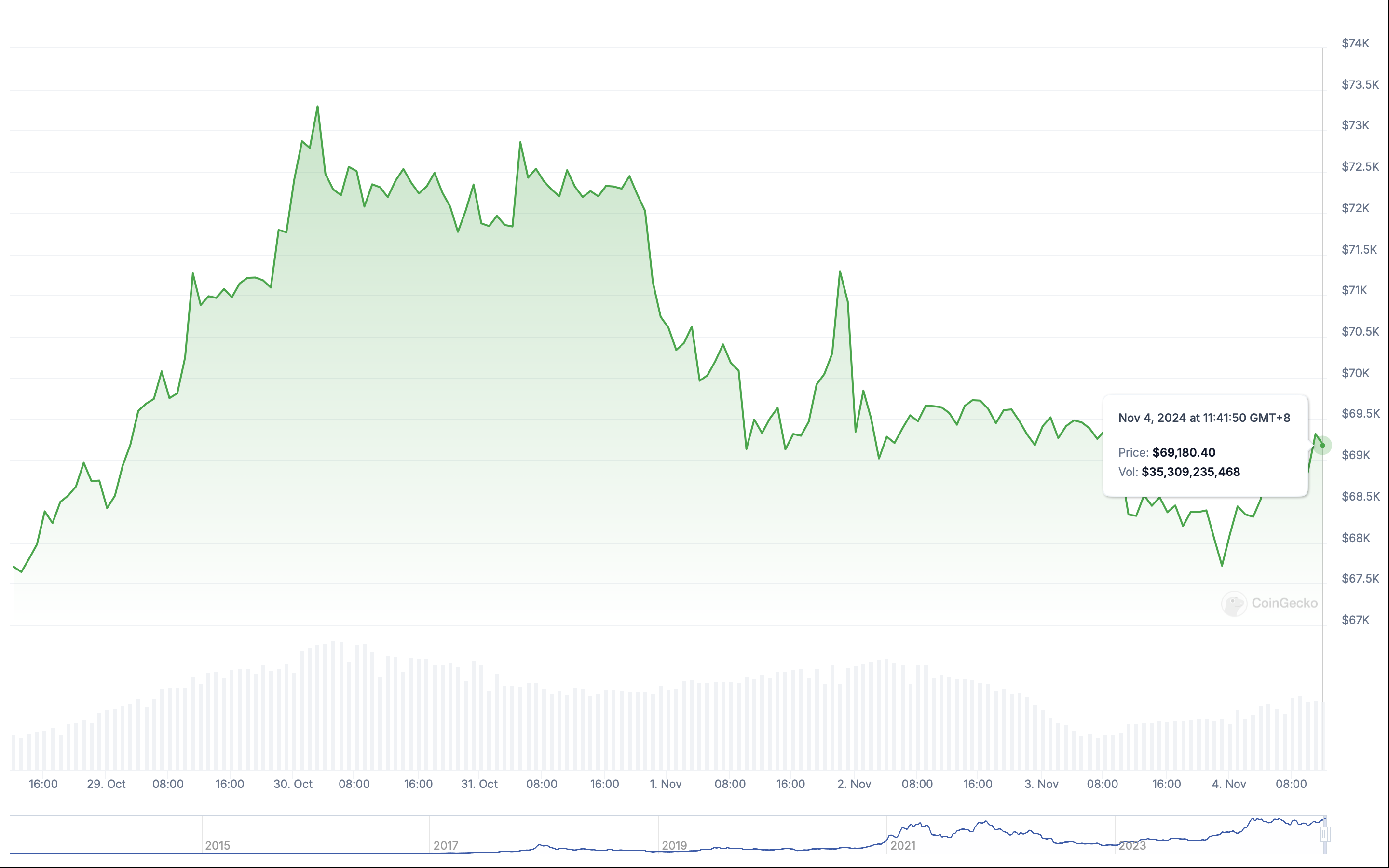

Amid the activity of long-dormant Bitcoin wallets, the BTC/USD trading pair remains under pressure. After testing resistance at the $71,850 level—coinciding with the 23.6% Fibonacci retracement—the price has since retreated, falling below the 50-period EMA near $69,720.

This trend suggests that momentum may be weakening, with the following levels in focus:

1. Immediate Support: The 61.8% Fibonacci retracement level around $68,700 serves as a crucial support point. Should Bitcoin break below this level, the next supports could be at $67,280 and $66,370.

2. Resistance Levels: Immediate resistance is seen at $69,660, with more significant resistance near the previous high of $71,850. Reclaiming these levels could potentially turn the sentiment more bullish.

3. Technical Indicators: The Relative Strength Index (RSI) currently reads 39, indicating a bearish bias. Meanwhile, the 50 EMA around $69,720 has shifted to a resistance level, reinforcing the likelihood of downside risk.

With dormant whales now back in action and Bitcoin nearing crucial technical thresholds, investors may want to monitor price movements closely.

A break below $68,700 could signal further declines, while a push past $71,850 might reignite bullish momentum.

Key Takeaways:

- 1. Dormant Whales Awaken: Several long-inactive Bitcoin wallets have been reactivated, including one that moved 159 BTC at a 700,000% profit.

- 2. Market Sentiment Shifts: Whale activity could indicate profit-taking at current resistance levels or reactions to regulatory and security concerns.

- 3. Technical Levels to Watch: Bitcoin’s immediate support lies at $68,700; a drop below this level could deepen losses, while a reclaim of $71,850 may signal renewed bullish strength.

As Bitcoin moves through a period of heightened whale activity and approaches technical pivot points, the market remains poised for potential volatility.