Leave Your Message

In 2023, the crypto market continues to evolve rapidly. Many investors are keen to explore the best coins to mine. The idea of finding the right "Crypto To Mine" has become more important than ever. Profitability can vary, making research crucial.

As the demand for cryptocurrencies grows, mining offers unique opportunities. Miners should be aware of the trends affecting each coin. Some cryptocurrencies may be more profitable than others under various conditions.

However, not all mining ventures guarantee success. Factors like energy costs and hardware efficiency could impact earnings. It's essential to analyze which coins may yield the best returns in the current landscape. The road to finding the ideal "Crypto To Mine" is filled with both potential and challenges.

Cryptocurrency mining is evolving rapidly in 2023. The profitability of mining varies widely across different coins. Factors like market demand, energy costs, and hardware efficiency play critical roles. A recent report noted that Bitcoin remains dominant. However, alternatives are gaining traction due to lower entry costs.

In 2023, Ethereum’s shift to Proof of Stake has led miners to explore other options. Coins like Monero and Ravencoin are rising in popularity. Data indicates profitability can fluctuate; some miners report earnings dropping by 30% year-over-year. Keeping up with algorithm changes and network adjustments is crucial for success.

Energy consumption is a vital consideration. The global energy consumption for mining is estimated to be staggering, with some regions facing regulatory challenges. Miners must evaluate their power sources carefully, as costs can significantly affect profits. Balancing energy efficiency with desired returns can pose a challenge. This dynamic market requires constant research and strategic planning.

When considering which cryptocurrencies to mine in 2023, it’s vital to focus on key factors that influence profitability. Energy costs stand out. Miners require a lot of power. If the energy prices rise, profit margins shrink. Always check local electricity rates.

Hardware performance also plays a crucial role. The efficiency of mining rigs matters. Older models consume excess power and yield lower returns. Investing in newer technology can make a difference. However, the initial cost may deter some miners.

Tips: Monitor market trends regularly. Prices can fluctuate dramatically. Be prepared for unexpected drops. Diversifying your mining portfolio may help mitigate risks. Another strategy is to join mining pools, pooling resources leads to more consistent payouts. Reflect on your strategy periodically; what worked months ago may not be effective today.

| Rank | Coin | Current Price (USD) | Market Cap (Million USD) | Hash Rate (TH/s) | Mining Difficulty | Profitability (USD/day) |

|---|---|---|---|---|---|---|

| 1 | Bitcoin | $27,000 | $530,000 | 100 | 20T | $10.00 |

| 2 | Ethereum | $1,800 | $200,000 | 800 | 5T | $6.00 |

| 3 | Litecoin | $100 | $7,000 | 50 | 3T | $2.50 |

| 4 | Monero | $160 | $3,000 | 20 | 2T | $1.75 |

| 5 | Zcash | $40 | $500 | 10 | 1T | $1.30 |

| 6 | Ravencoin | $0.07 | $800 | 15 | 800M | $0.25 |

| 7 | Dogecoin | $0.06 | $8,000 | 50 | 2T | $0.15 |

| 8 | Ethereum Classic | $35 | $4,000 | 20 | 500M | $1.20 |

| 9 | Bitcoin Cash | $130 | $2,500 | 50 | 1T | $2.00 |

| 10 | Dash | $60 | $700 | 15 | 500M | $1.50 |

Mining cryptocurrencies in 2023 presents unique opportunities. Several coins stand out for potential profitability. The energy costs and mining difficulties vary, affecting overall returns.

According to recent reports, Bitcoin remains a popular choice but faces stiff competition. Emerging coins like Ethereum's successor boast lower barriers. Data shows that altcoins can yield surprising returns, sometimes exceeding 100%.

Some miners overlook the environmental impacts of mining activities. High energy consumption can lead to increased costs. It’s crucial to consider efficiency. Renewable energy sources can mitigate expenses. As the mining landscape evolves, finding profitable, eco-friendly options grows essential. Miners must adapt strategies continuously. Understanding market trends and mining dynamics is critical for success.

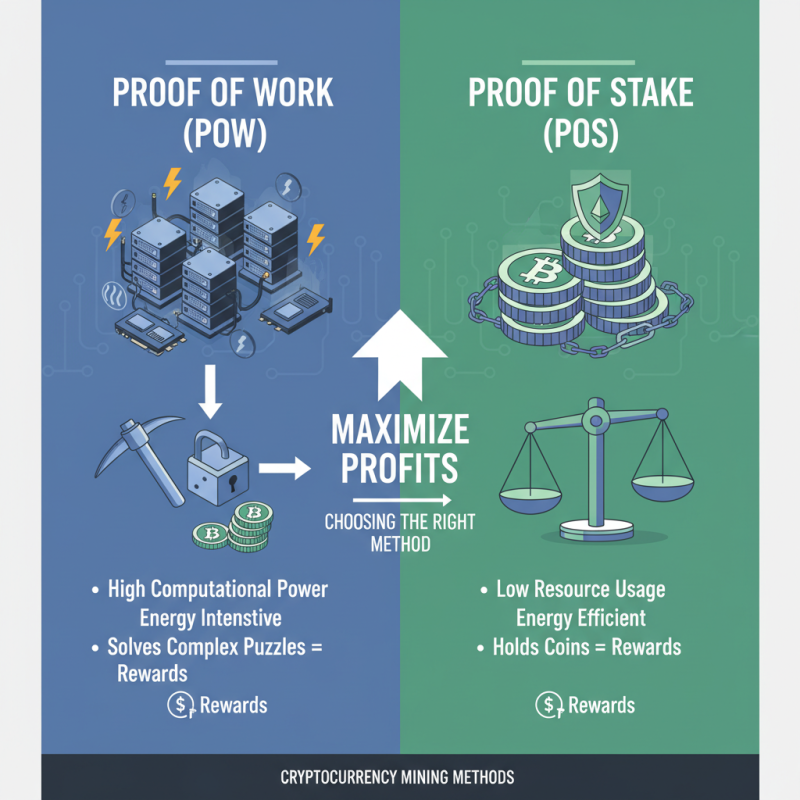

Choosing the right mining method is crucial for maximized profits in cryptocurrency mining. Two primary methods are Proof of Work (PoW) and Proof of Stake (PoS). PoW requires significant computational power and cost. Miners solve complex mathematical puzzles to validate transactions. This process can consume large amounts of electricity. In contrast, PoS is less resource-intensive. It rewards users based on the number of coins they hold.

Each method has its own challenges. PoW can lead to centralization as only those with powerful machines can compete. This may discourage smaller miners. PoS, however, raises concerns about wealth concentration. Wealthy users could dominate the network. Deciding which method to pursue is not easy.

Additionally, environmental impacts are a hot topic. PoW is often criticized for high energy consumption. PoS might be seen as a greener alternative. Yet, it also faces scrutiny regarding fairness and distribution. Miners must weigh their options carefully. There is no one-size-fits-all approach. Understanding the implications of each method is essential for growth in the mining space.

The future of cryptocurrency mining is evolving rapidly. As technology advances, so do the methods miners use to extract profits. Many miners are now looking at renewable energy sources. This shift not only cuts costs but also aligns with global sustainability goals. However, this approach can be challenging. Access to reliable green energy is limited in some areas.

During this transition, miners should adjust their strategies. The volatility of cryptocurrencies remains a significant factor. Fluctuations in coin values can impact profit margins. Understanding market trends is crucial. This knowledge allows miners to make informed decisions. Regularly analyzing potential coins is essential.

**Tips:** Consider diversifying your mining portfolio. Multiple coins can balance out risks. Always stay updated on regulatory changes in your location. Compliance is vital for long-term success. Technology investments can enhance efficiency. Upgrading equipment may be costly, but it increases profit potential.