Leave Your Message

The Cryptocurrency Market is evolving rapidly. Investors and enthusiasts should pay close attention to emerging trends. These trends can shape the future of digital currencies.

One notable trend is the increased institutional adoption. Many large companies are entering the Cryptocurrency Market. This shift can lead to greater mainstream acceptance. Additionally, regulations are becoming tighter. Governments are establishing clearer rules. This can create both challenges and opportunities for traders.

Technological advancements also play a significant role. Innovations like decentralized finance (DeFi) and non-fungible tokens (NFTs) are gaining traction. However, the volatility of crypto assets remains a concern. Market fluctuations can be unpredictable and drastic. A careful approach is needed when navigating these changes in the Cryptocurrency Market. Understanding these trends can help individuals make informed decisions.

Emerging technologies are shaping the cryptocurrency landscape in profound ways. One significant trend is the rise of blockchain interoperability. This technology allows different blockchain networks to communicate with one another. It enables seamless data transfer and promotes collaboration among various crypto projects. However, achieving true interoperability remains a challenge.

Another notable development is the integration of artificial intelligence in trading strategies. AI-driven algorithms analyze vast data sets rapidly. They can identify patterns and predict market trends more accurately than humans. Yet, these systems can falter during unexpected market shifts. Relying solely on AI might overlook the human intuition that often guides traders.

Decentralized finance (DeFi) platforms are also gaining momentum. They offer financial services without traditional intermediaries. Users can lend, borrow, and earn interest directly using cryptocurrencies. This shift democratizes access to financial tools. However, the risks associated with smart contracts and liquidity remain areas for caution. The market is evolving, and understanding these technologies is key to navigating this space.

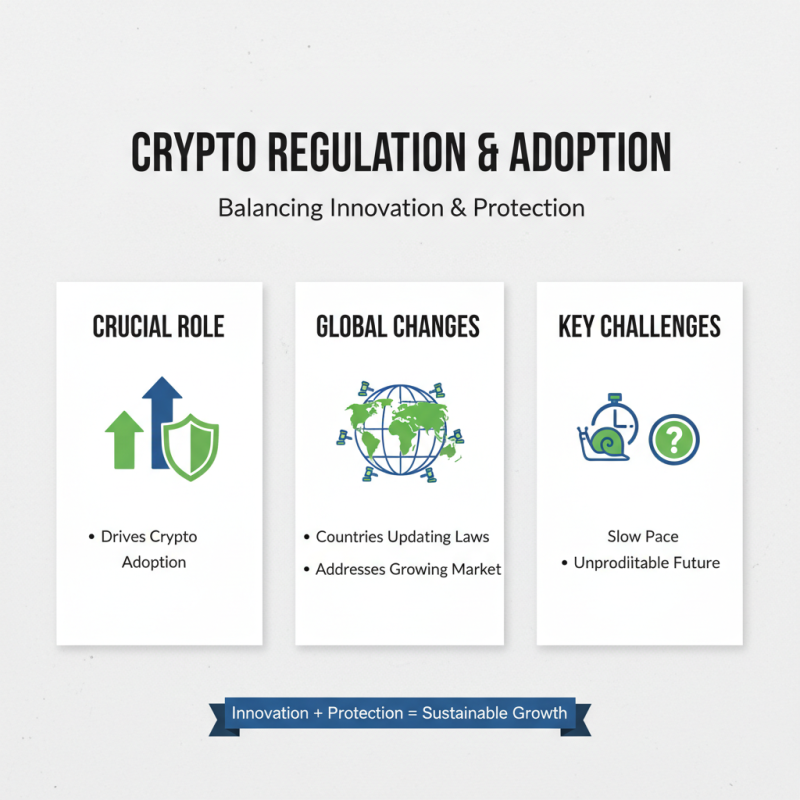

Regulatory developments play a crucial role in cryptocurrency adoption. Many countries are updating their laws to address this growing market. Policymakers aim to strike a balance between innovation and consumer protection. However, the pace of these changes often feels slow and unpredictable.

Some regulations offer clear guidelines for businesses. Others create confusion and hesitation among investors. Uncertainty can halt progress. Developers may hesitate to launch new projects. Consumers may feel insecure about their investments. Each regulation can significantly impact public perception of cryptocurrency.

The landscape is constantly shifting. Countries vary greatly in their approach. Some embrace cryptocurrencies, while others impose strict regulations. This inconsistency can lead to a lack of trust. Many are left wondering what changes might come next. Future growth requires collaboration between regulators and the crypto community. Without this partnership, the road ahead may be bumpy.

Institutional investment in cryptocurrencies has surged significantly. In 2023, it was reported that around 20% of institutional investors have allocated assets to digital currencies. This shift indicates a growing acceptance of cryptocurrencies as a legitimate asset class. The total market cap of cryptocurrencies reached nearly $2 trillion, driven by institutional money entering the market.

Factors influencing these investments include diversification and inflation hedging. Many institutions view cryptocurrencies as a hedge against traditional market volatility. More than 40% of asset managers believe blockchain technology will reshape financial services entirely. However, the uncertainties and regulatory changes still create hesitance. Risk management remains a key concern for these investors.

Tips:

Shifts in public perception are reshaping the cryptocurrency landscape. According to a recent survey, about 46% of respondents view cryptocurrencies as a viable investment. This marks a significant increase compared to previous years. The enthusiasm is evident, but so are the concerns. Many people still associate cryptocurrencies with volatility and scams. Trust remains a major hurdle.

Community engagement in cryptocurrency has become crucial. Platforms that foster active discussions and transparency are seeing increased participation. Data indicates that communities with strong engagement report higher trading volumes. Yet, this has a flip side. Many projects suffer from echo chambers, where only confirmed beliefs circulate. New ideas often face resistance, stifling innovation.

Consumer education is essential as perceptions shift. A report found that 60% of potential investors lack basic knowledge about blockchain technology. This gap can hinder growth and participation. It’s vital for the community to focus on informative content. Addressing misconceptions can build a more inclusive environment. As interest grows, so does the responsibility of the community to guide newcomers effectively.

| Trend | Description | Impact Level | Community Engagement |

|---|---|---|---|

| Increased Regulation | Governments are implementing stricter regulations on crypto trading and ICOs. | High | Moderate |

| NFT Market Growth | Non-fungible tokens are gaining traction in both art and gaming. | Medium | High |

| Institutional Investment | More institutional investors are entering the crypto market. | High | Medium |

| Decentralized Finance (DeFi) | The rise of DeFi platforms is changing traditional finance dynamics. | High | High |

| Sustainability Focus | There is a growing emphasis on environmentally friendly cryptocurrencies. | Medium | Medium |

| Blockchain for Supply Chain | Using blockchain for transparency in supply chain management. | Medium | Low |

| Cross-Border Payments | Cryptocurrencies are increasingly used for international transactions. | Medium | High |

| Community Governance | The rise of DAOs is empowering communities in decision-making. | Medium | High |

| Payment Integration | More merchants are accepting cryptocurrencies as payment. | High | Medium |

Decentralized Finance, or DeFi, is revolutionizing the financial landscape. It allows users to engage with financial services without intermediaries. This opens new opportunities for savings, lending, and trading. The absence of centralized control reduces costs and enhances accessibility. However, this shift also raises concerns about security and regulation.

Many users are drawn to DeFi for its potential. Smart contracts automate transactions, making processes faster and more transparent. Yet, the complexity can be daunting. Users face risks such as bugs in code and market volatility. Trusting protocols requires diligence and understanding. Not everyone fully comprehends the mechanics behind these systems.

As DeFi evolves, its impact on traditional finance is undeniable. Traditional banks may find challenges competing with DeFi’s efficiencies. This evolution prompts a rethink of the role of banks in our society. The future may see a blend of both worlds, creating a more inclusive financial ecosystem. Embracing change involves navigating risks and opportunities, which is not always easy.