Leave Your Message

As the cryptocurrency mining landscape continues to evolve, the demand for efficient and powerful mining hardware remains a focal point for both new and seasoned miners. Among these, the Asic Miner is often hailed for its exceptional performance, specifically designed to handle a single algorithm efficiently. According to a recent report by Bitwise, the energy consumption of Bitcoin mining alone reached 87 terawatt-hours in 2021, prompting miners to seek alternatives that not only optimize performance but also reduce operational costs. In light of this, exploring top alternatives to Asic Miners is crucial for gaining a competitive edge while ensuring sustainability. The benefits of leveraging diverse mining technologies can lead to enhanced efficiency and profitability, making it essential for miners to stay informed on the available options beyond traditional Asic platforms.

ASIC miners, or Application-Specific Integrated Circuits, are specialized hardware designed specifically for cryptocurrency mining. Unlike traditional CPUs or GPUs which can be used for a variety of tasks, ASIC miners are optimized for a single cryptocurrency algorithm, providing remarkable efficiency and hashing power. According to a report by the Cambridge Centre for Alternative Finance, as of 2023, ASIC miners account for approximately 95% of the total Bitcoin network's hashing power, underscoring their dominance in the landscape of mining operations.

The working principle of ASIC miners involves solving complex mathematical problems called hash functions, which validate and secure transactions on blockchain networks. This process not only confirms transactions but also rewards miners with cryptocurrency, creating an incentive for investment in mining hardware. With the rise in energy costs, the efficiency of these machines is more crucial than ever. The Bitcoin Mining Council reported that, as of Q3 2023, the global Bitcoin mining industry has seen a shift towards more sustainable practices, with a notable 56% of miners utilizing renewable energy sources. The role of ASIC miners in this context is increasingly vital, as they provide a high degree of efficiency and performance needed to navigate the challenges of modern-day cryptocurrency mining.

| Alternative Miner Type | Hash Rate (GH/s) | Power Consumption (W) | Efficiency (J/GH) | Price Range ($) |

|---|---|---|---|---|

| GPU Miner | 120 | 300 | 2.5 | 700 - 1200 |

| FPGA Miner | 200 | 150 | 0.75 | 800 - 1500 |

| Cloud Mining | Variable | N/A | N/A | 50 - 250 |

| ASIC Miner (Alternative) | 1400 | 1300 | 0.93 | 2000 - 3000 |

When considering alternatives to the best ASIC miners, it’s crucial to evaluate several key factors that will shape your mining success. First and foremost, the compatibility of the mining hardware with various cryptocurrencies should be assessed. Different mining algorithms require specific equipment, so understanding which coins you plan to mine will directly influence your choice of hardware. Additionally, look into the power consumption and efficiency of the alternative solutions. Higher efficiency means lower operational costs, making it essential to find miners that balance performance with energy usage.

Another significant factor is the availability of support and community engagement surrounding the mining hardware. A vibrant community can provide invaluable resources, such as troubleshooting tips and optimization strategies. Furthermore, manufacturers that offer robust customer service and regular firmware updates ensure that your investment remains viable in the ever-evolving crypto landscape. Lastly, consider the initial investment versus the potential return on investment. Thoroughly analyzing these factors will help you make an informed decision about which alternative mining solutions will best meet your needs and enhance your mining operations.

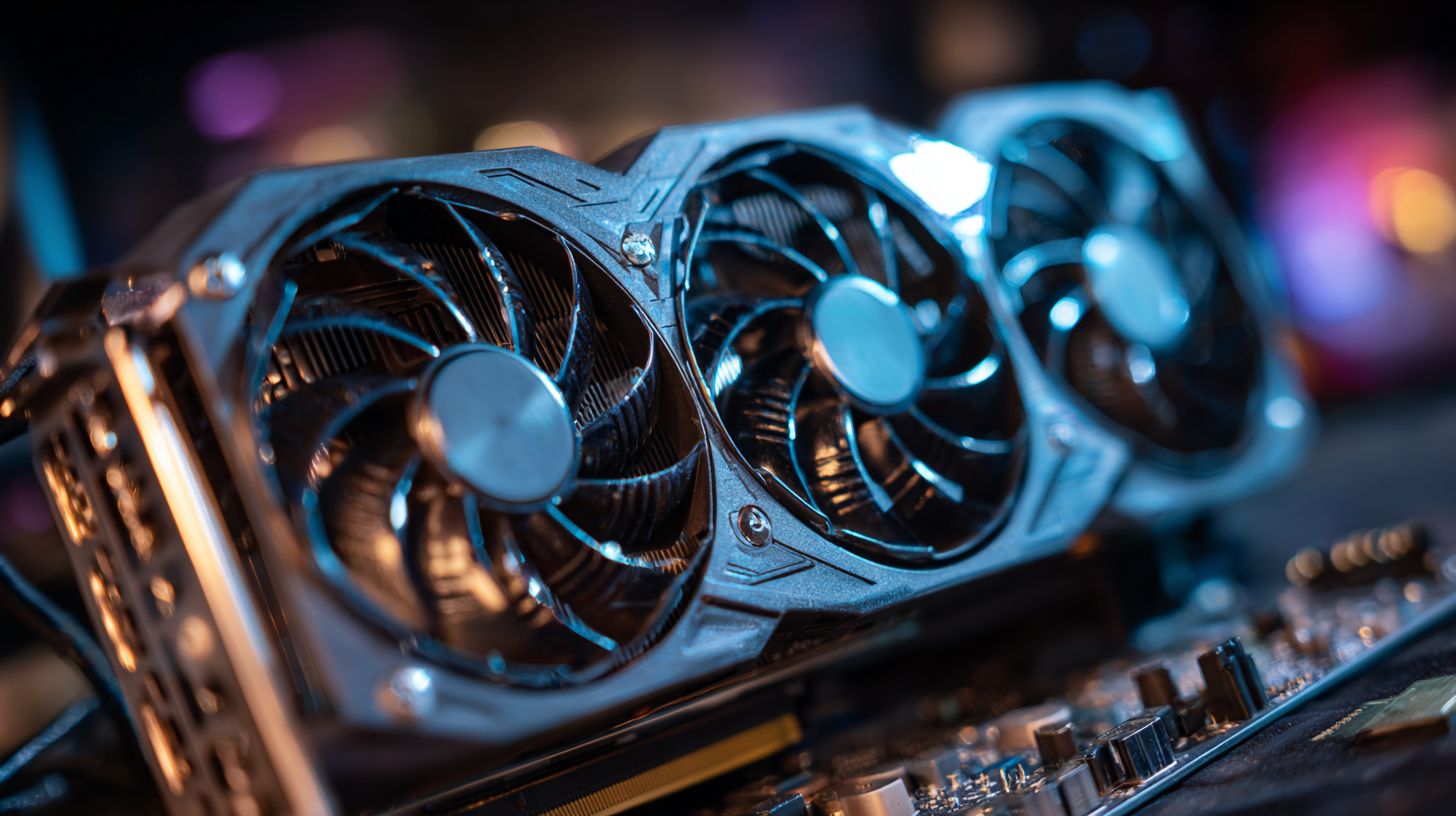

While ASIC miners are often regarded as the gold standard for cryptocurrency mining due to their high efficiency and performance metrics, several alternatives are beginning to challenge their dominance. GPU mining rigs, for instance, have seen a resurgence in popularity, particularly for coins that resist ASIC mining. According to a recent report by CoinMetrics, GPU miners can achieve hash rates upwards of 60 MH/s for Ethereum, which allows flexibility in switching between assets based on market trends. This adaptability not only enables miners to capitalize on price fluctuations but also significantly reduces dependency on a single mining hardware type.

Another noteworthy alternative is FPGA (Field-Programmable Gate Array) miners. While initially seen as complex and less user-friendly, their performance has improved dramatically. A report from BitOoda indicates that FPGA miners can deliver hash rates that compete closely with top-tier ASIC miners while consuming significantly less power—often showing a power efficiency of around 0.3 J/GH compared to traditional ASICs, which typically range from 0.5 to 1.0 J/GH. As energy costs continue to rise, the cost efficiency of FPGA solutions is attracting miners looking for sustainable profitability. The evolving landscape of cryptocurrency mining technology suggests that alternatives to ASIC miners are becoming crucial in diversifying mining strategies and optimizing overall efficiency.

The evolution of mining technology is paramount as the industry seeks more efficient solutions. In recent innovations, direct liquid-to-chip cooling systems have emerged as game-changers, significantly enhancing performance and scalability in ASIC miners. The new designs not only promise higher terahash rates but also improve thermal management, allowing miners to operate at optimal efficiency. Companies are rapidly adopting these advanced cooling technologies to push the boundaries of what ASIC miners can achieve.

Additionally, open-source ASIC miners are gaining traction, focusing on community-driven improvements and accessibility. The launch of platforms that support both high-performance mining and features like immersion cooling reflects a shift towards decentralized, user-friendly solutions. This trend empowers enthusiasts and home miners to participate effectively in cryptocurrency mining, while companies are expanding their portfolios with modular systems that cater to different operational scales. Innovations like these bridge the gap between complex mining technology and average users, democratizing the mining landscape.

As the cryptocurrency mining landscape continuously evolves, the quest for efficiency and sustainability in mining hardware remains at the forefront of industry trends. The future of mining solutions is leaning towards innovations that not only enhance performance but also minimize environmental impact. With rising energy costs and global environmental concerns, miners are increasingly seeking alternative hardware solutions that prioritize energy efficiency alongside hashing power. This shift is prompting manufacturers to explore novel designs, such as ASIC miners with improved energy ratios, and miners that utilize alternative cooling technologies like immersion cooling.

Moreover, advancements in software are playing a pivotal role in optimizing mining operations. Smart algorithms are being developed to intelligently manage power consumption and operational efficiency, allowing miners to adapt to market demands in real time. Additionally, the emergence of green mining initiatives, which advocate for the use of renewable energy sources, is expected to gain momentum. These trends indicate a transformative phase in the mining industry, where sustainability is not merely a goal but an operational mandate. As the market becomes more aware of these changes, the demand for innovative, eco-friendly mining solutions will likely outpace traditional approaches, setting a new standard for future mining endeavors.