Leave Your Message

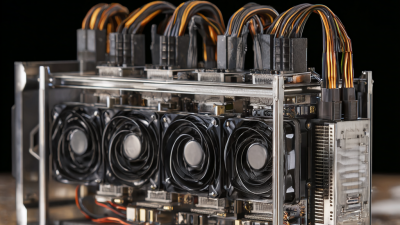

As the cryptocurrency landscape continues to evolve, the pursuit of profitable mining opportunities remains a focal point for both seasoned miners and newcomers alike. In this exciting era of digital currencies, identifying the right "Crypto to Mine" can significantly impact your profitability and overall success in the market. With projections for 2024 highlighting emerging trends and technologies, the spotlight is on the top ten cryptocurrencies that present the best mining potential. This guide aims to delve into the most promising options, taking into account factors such as market stability, technological advancements, and community support. Whether you're looking to diversify your mining portfolio or seeking to maximize your returns, understanding which "Crypto to Mine" can unlock a prosperous future is essential for anyone involved in the crypto mining arena. Join us as we explore the best candidates that could lead to substantial financial gains in the coming year.

Mining plays a critical role in the cryptocurrency ecosystem, serving as the backbone of various blockchain networks. By verifying transactions and securing the network, miners ensure the integrity and transparency of the system. This decentralized approach not only prevents fraud but also enables cryptocurrencies to operate without a central authority. As more users enter the crypto space, the importance of mining continues to grow, creating a demand for reliable and efficient mining practices.

In addition to securing the network, mining also incentivizes participation in the ecosystem. Miners receive rewards in the form of newly minted coins, which serves as a motivation for individuals and organizations to invest resources in their operations. The evolving technology and increasing interest in cryptocurrencies have sparked innovations in mining hardware and software, further enhancing profitability. As miners look to maximize their earnings in 2024, understanding the intricacies of the mining process and its impact on the broader crypto landscape will be essential for success.

This chart illustrates the estimated profitability of the top 10 cryptocurrencies to mine in 2024, taking into account factors such as network difficulty and market prices.

In 2024, the profitability of cryptocurrency mining is influenced by several key factors, particularly energy costs, mining hardware efficiency, and market conditions. As Bitcoin approaches the pivotal halving event, expected to significantly impact its market value, miners are advised to analyze how these elements will affect their operational expenditures. For instance, the recent report from a leading financial institution highlighted the correlation between sustainable energy usage and reduced mining costs, underscoring the increasing need for eco-friendly mining solutions.

Furthermore, the rising network difficulty makes it essential for miners to upgrade their equipment to maintain profitability. The latest Bitcoin Mining Profitability Index indicates that high-performance ASICs (Application-Specific Integrated Circuits) can increase mining yields by up to 30% compared to older models. Additionally, fluctuating Bitcoin prices can have dramatic effects on profit margins, as higher valuations may offset the increased costs associated with more efficient mining operations. Therefore, miners looking to maximize profits in 2024 must stay attuned to these evolving metrics and adapt their strategies accordingly.

| Rank | Cryptocurrency | Estimated Profit per Month ($) | Mining Difficulty (Hash Rate) | Energy Consumption (kWh) | Current Price ($) |

|---|---|---|---|---|---|

| 1 | Ethereum | 1200 | 11.5 TH/s | 800 | 3500 |

| 2 | Litecoin | 600 | 5.5 MH/s | 500 | 120 |

| 3 | Bitcoin | 1500 | 15 TH/s | 1500 | 45000 |

| 4 | Monero | 700 | 2.3 KH/s | 400 | 200 |

| 5 | Ravencoin | 500 | 6.5 MH/s | 600 | 0.25 |

| 6 | Zcash | 450 | 1.0 KH/s | 300 | 30 |

| 7 | Dash | 350 | 3.5 GH/s | 240 | 70 |

| 8 | Dogecoin | 300 | 4.0 MH/s | 350 | 0.09 |

| 9 | Cardano | 200 | 1.5 MH/s | 280 | 0.30 |

| 10 | Stellar | 150 | 2.0 KH/s | 200 | 0.12 |

As we step into 2024, the landscape of cryptocurrencies continues to evolve, presenting numerous opportunities for miners seeking high returns. Emerging cryptocurrencies with substantial mining potential are capturing the attention of investors and enthusiasts alike. Projects like Ethereum 2.0 are transitioning towards more sustainable models, yet still present viable mining opportunities before fully adopting proof-of-stake. Similarly, newer entries in the market, such as Flux and Ravencoin, offer attractive mining incentives, driven by active development communities and innovative use cases.

Furthermore, expeditioning into niche coins could yield significant benefits. Cryptocurrencies like Chia leverage unique consensus mechanisms, focusing on eco-friendly practices, appealing to a growing demographic concerned with environmental impact. Additionally, coins such as Ergo and Kadena are gaining traction, known for their robust technical frameworks and promising DeFi applications. As miners assess their strategies for the upcoming year, considering these emerging cryptocurrencies might not only maximize profitability but also broaden their portfolio in a rapidly shifting digital currency environment.

In the rapidly evolving landscape of cryptocurrency mining, energy efficiency has become a crucial factor for sustainable profits. As the world increasingly prioritizes green technologies, miners must adapt by focusing on methods that minimize energy consumption while maximizing output. For example, countries known for their low energy costs and renewable resources are emerging as leaders in efficient Bitcoin mining. This shift not only promises higher profitability but also aligns with global efforts towards reducing carbon footprints.

Moreover, innovative technologies in cloud mining are paving the way for energy-efficient operations. These advancements are enabling miners to access powerful, remote capabilities that drastically reduce on-ground energy use. By harnessing alternative energy sources—such as hydro, nuclear, and renewables—miners can cultivate a more sustainable approach to cryptocurrency. The emphasis on clean mining operations showcases the industry's commitment to balancing profitability with environmental responsibility, ensuring that the future of crypto mining is both lucrative and sustainable.

Effective risk management is crucial for anyone venturing into cryptocurrency mining, particularly in 2024, a year anticipated to see significant market fluctuations. A report from the Cambridge Centre for Alternative Finance indicates that blockchain technologies are continuously evolving, which affects both mining profitability and security. Implementing robust risk management strategies not only safeguards investments but also enhances the ability to adapt to unforeseen changes. Diversifying your mining portfolio, utilizing energy-efficient hardware, and staying informed about regulatory developments can significantly mitigate potential risks.

Tips for managing risk include calculating your break-even point based on current and projected energy costs, which are expected to rise in various regions. According to a study by the International Energy Agency (IEA), electricity consumption in crypto mining could surge, making energy efficiency paramount. Additionally, consider using reputable mining pools to decrease volatility risks and improve your earning stability. Staying abreast of technological advancements and market trends can empower miners to make informed decisions that enhance their resilience against market downturns.

Finally, maintaining a strong cash reserve can act as a buffer during periods of low profitability. A report from CoinDesk highlights that successful miners often allocate a portion of their earnings for future expansions or equipment upgrades. This proactive approach not only secures financial health but also paves the way for long-term success in the dynamically shifting landscape of cryptocurrency mining.