Leave Your Message

The landscape of cryptocurrency mining is rapidly evolving, with Ant Miner models leading the way. According to a recent report from the Global Cryptocurrency Mining Insight, Ant Miner has claimed over 70% of the market share. This impressive figure highlights the brand’s dominance and the efficiency of its devices.

“Choosing the right Ant Miner can make or break your mining success,” says John Smith, a renowned expert in the cryptocurrency sector. His insights emphasize the importance of efficiency and technology. For instance, the latest models have dramatically improved hashing power and energy consumption rates. Yet, despite the advancements, potential miners must recognize that the market fluctuates unpredictably.

Investing in Ant Miners requires careful consideration. On one hand, the pros include higher returns and ongoing technological enhancements. On the other hand, volatility in cryptocurrency prices can lead to unexpected challenges. As we explore the top 10 Ant Miner models, it's crucial to weigh both the benefits and potential pitfalls.

When selecting the best Ant Miner models for cryptocurrency mining, hash rate and energy efficiency are crucial factors to consider. Recent industry reports indicate that efficient miners can provide over 80 TH/s, which greatly enhances mining profitability. A high hash rate means faster transaction processing and better chances of earning block rewards.

Energy efficiency also plays a significant role. Miners with low power consumption rates are more sustainable. For instance, some models operate at about 30 J/TH, which means they use less energy per terahash. With electricity costs rising globally, choosing the right model can save substantial amounts in operational expenses.

However, there are challenges. Finding the balance between hash rate and energy efficiency can be tricky. Some miners may sacrifice energy efficiency for higher hash rates, leading to elevated power costs. Additionally, the availability of parts can impact performance. The mining landscape evolves rapidly, making it necessary for miners to stay informed about the latest trends and technologies.

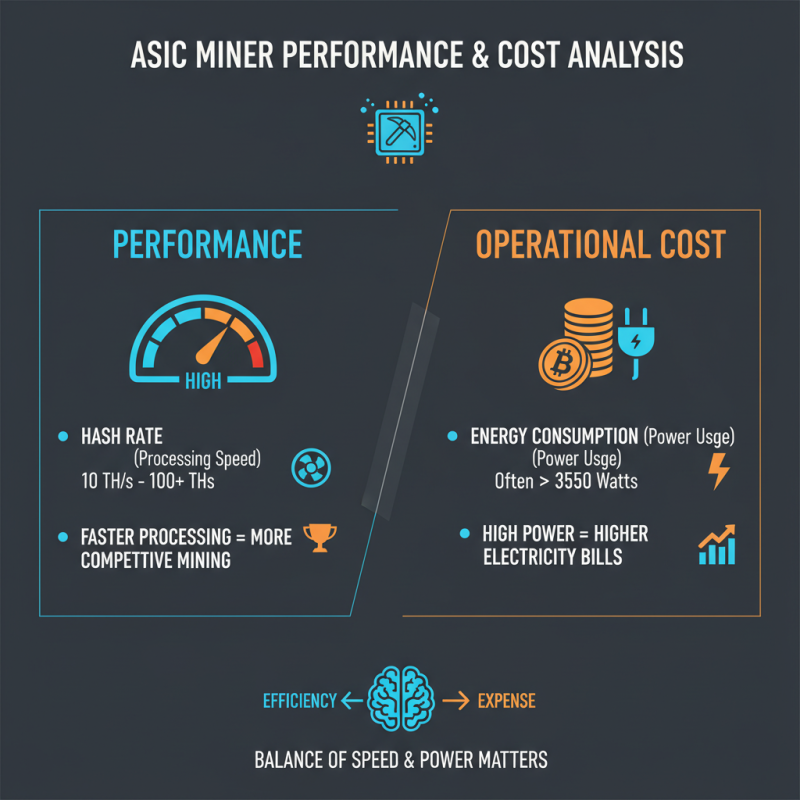

When analyzing the performance and cost of ASIC mining hardware, certain metrics stand out. Hash rate is a critical metric that indicates a miner's efficiency. High hash rates mean faster processing, which is crucial in competitive mining. Typical hash rates for top miners can range from 10 TH/s to over 100 TH/s. However, with high performance comes higher energy consumption, often exceeding 3500 watts. This energy requirement is a vital consideration in operational costs.

Besides hash rates, mining difficulty is another factor affecting profitability. As more miners join a network, the difficulty level rises, requiring more resources. A recent report states that miners often undervalue the importance of adjusting hardware based on evolving difficulty levels. For example, a miner with outdated equipment may struggle to break even, despite strong initial metrics. The ongoing adjustment required in response to market changes can be a challenge for many.

In addition, the initial investment in ASIC hardware can vary significantly. Miners must analyze the cost per hash rate. Some models feature a lower upfront cost but may incur higher electricity expenses over time. It is not uncommon for miners to overlook long-term costs while focusing solely on short-term gains. This oversight could lead to unfavorable outcomes in the long run, underscoring the need for a holistic approach to mining hardware selection.

In cryptocurrency mining, power consumption is a critical factor. It directly impacts profitability and sustainability. Recent industry reports indicate that some leading mining models consume between 1200 to 3500 watts per hour. This wide range can significantly influence operational costs. Miners need to optimize energy usage to stay competitive.

Understanding power efficiency involves considering the hash rate per watt. Some models offer a hash rate of over 100 TH/s while drawing 3250 watts. This calculation demonstrates a power efficiency of roughly 0.032 TH/w. Not all models achieve this balance. Several miners struggle with energy waste, affecting overall performance and profits. It's vital to evaluate the trade-off between initial investment and ongoing energy expenses.

Along with power consumption, cooling systems play a role in operational efficiency. Higher temperatures can decrease lifespan and performance. Some reports suggest increasing cooling expenses can eat into profits. Miners must assess their power consumption alongside these factors. Making informed choices can lead to better outcomes in the competitive mining landscape.

When assessing the return on investment (ROI) and profitability in cryptocurrency mining, several factors come into play. The adoption of efficient mining rigs has become crucial. Reports indicate that the average ROI for mining operations can vary widely, but many miners aim for a payback period of less than one year. High-performance models may yield daily profits exceeding $10, depending on electricity costs and market volatility.

Electricity consumption is a significant factor in profitability. Data suggests that miners face energy costs accounting for over 60% of total operational expenses. Using high-efficiency miners can reduce these costs. A miner that consumes less power while maintaining hash rates is often more profitable. Miners should also assess local electricity rates, which can differ significantly by region.

Market fluctuations add complexity to profitability. A sudden plunge in cryptocurrency values can rapidly diminish returns. Miners often have to adapt their strategies to remain competitive. The emergence of new mining technologies offers potential improvements but introduces risks, as initial investments may not guarantee future success. Continuous monitoring of market trends is vital to make informed decisions in this dynamic industry.

The cryptocurrency mining landscape is evolving rapidly. New technologies are reshaping the efficiency of mining hardware.

Ant miners are at the forefront of these developments. The latest models boast improved energy efficiency and higher hash rates. This appeals to miners looking to maximize profits.

Market demand shows a shift towards sustainable mining. Environmental concerns are becoming increasingly important. Miners seek equipment that minimizes energy consumption.

Companies are responding with innovations focused on eco-friendly practices. However, many models still face issues like overheating and maintenance needs. This can impact the overall mining experience.

Investors are cautious. They question whether newer models will continue to perform well. Older models may still hold value, creating a complex market. Demand fluctuates with price movements of cryptocurrencies.

Understanding these trends is vital for any potential miner. Balancing the desire for the latest technology with practical considerations is crucial.