Leave Your Message

As the world of cryptocurrencies evolves, many seek to explore opportunities. Starting a Bit Coin Miner in 2026 can be an exciting venture. The miners play a vital role in the Bitcoin network. They validate transactions and secure the blockchain. However, the process is not without challenges.

Understanding the technical requirements is crucial. Hardware choices, software tools, and energy costs demand careful consideration. Moreover, miners must stay updated with market trends. The competition is fierce in the mining landscape. Individual miners must strategize effectively to remain profitable. It’s vital to ask: What makes you different from others?

The journey may not be straightforward. Unexpected technical issues may arise. Additionally, fluctuations in Bitcoin prices can impact profitability. Reflect on potential setbacks before diving in. Starting a Bit Coin Miner requires not only ambition but also resilience. With the right approach, success is within reach.

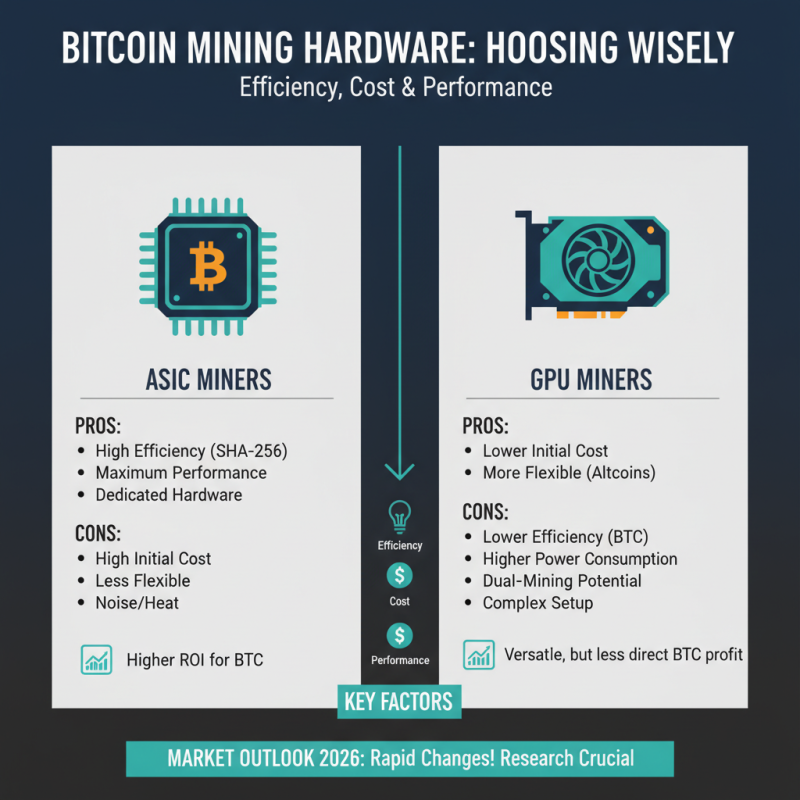

Choosing the right mining hardware for Bitcoin in 2026 is crucial. The market is changing rapidly. You have to consider efficiency, cost, and performance. ASIC miners are popular but come with a hefty price tag. There are also GPU miners, which offer more flexibility. However, they may not be as efficient for Bitcoin.

Tips: Look for energy-efficient models. These miners can save costs in the long run. Always check the hash rate. A higher hash rate means better performance.

Cooling is another important factor. Mining generates a lot of heat. Without proper cooling, your hardware will fail faster. Invest in good cooling systems. They can help prolong the life of your equipment.

Remember that prices fluctuate. Be prepared for potential changes. Research thoroughly before making a commitment. New technologies may emerge, changing the landscape. Stay updated and always reassess your options. Making the right choice now will benefit you in the future.

Bitcoin mining pools have emerged as a crucial element for miners aiming to maximize their efforts. By joining a pool, miners can combine their resources, increasing the chances of successfully adding a block to the blockchain. This collective work boosts the likelihood of earning rewards. A recent report from Cambridge Center for Alternative Finance shows that nearly 70% of Bitcoin miners are part of a mining pool.

However, there are pros and cons to consider. The main advantage is steady income. Pooled rewards allow miners to earn Bitcoin more consistently. Yet, some drawbacks exist. For instance, pool fees can cut into profits. Depending on the pool, these fees may range from 1% to 3%. Additionally, miners must trust the pool operator to distribute rewards fairly.

Tips: Always research pools carefully. Look for ones with good reputations and low fees. Diversifying across various pools can mitigate risks. Transparency is key. Some pools provide detailed earnings reports, which should be a significant factor in your choice.

Remember, joining a mining pool doesn’t guarantee profits. Market volatility can still impact earnings. Evaluating the pool’s payout structure is essential. Be aware of how often rewards are distributed and the minimum payout thresholds.

This chart compares the hash rate distribution among several popular Bitcoin mining pools in 2026. The data is based on estimated hash rates in TH/s (terahashes per second).

Location and power are critical when setting up Bitcoin mining operations in 2026. Choosing the right geographical location can significantly impact both profitability and efficiency. A study by the Cambridge Centre for Alternative Finance suggests that regions with cooler climates, such as parts of Canada or northern Europe, can help with heat management. These locations often provide an extra edge, reducing cooling costs, which can eat into mining profits.

Power is another essential factor. The Bitcoin mining industry consumes vast amounts of electricity. According to the International Energy Agency, in 2022, global Bitcoin mining consumed approximately 100 terawatt-hours of electricity. Therefore, miners should consider areas with access to cheap and renewable energy. Hydroelectric power is a popular choice, offering lower costs while being environmentally sustainable. However, it's crucial to conduct thorough research as power rates can fluctuate. Miners need to ask if their chosen location has reliable infrastructure and stable energy supplies.

In addition, the cost of land and permits should not be overlooked. Some areas might seem economically attractive but come with hidden fees. It is essential to evaluate the overall cost of setup versus potential profit. Many miners find themselves facing unexpected challenges. Inadequate facilities or high operational costs can negate potential revenue. Thus, taking time to plan and analyze your location and power requirements is vital for a successful mining operation.

| Dimension | Details |

|---|---|

| Optimal Location | Cold regions with low electricity costs and remote access |

| Power Source | Renewable energy (solar, wind) or surplus energy |

| Cooling Solutions | Immersion cooling or mining farms with cooling systems |

| Mining Equipment | Latest ASIC miners with low power consumption |

| Internet Connectivity | High-speed and reliable internet connection |

| Regulatory Compliance | Compliance with local laws and regulations on cryptocurrency |

| Initial Investment | Cost of equipment, setup, and operational expenses |

| Profitability Factors | Market conditions, electricity rates, and mining difficulty |

In 2026, the landscape of Bitcoin mining has dramatically evolved, emphasizing the crucial role of software. Mining software is vital for optimizing the mining process and maximizing profitability. Recent studies reveal that the efficiency of mining software can influence a miner's overall output by up to 30%. Strategic choice here can determine success or failure.

Essential tools in 2026 include advanced hardware compatibility features and performance trackers. Many miners find themselves struggling to keep up with dynamic network difficulties. Often, software updates are required to maintain competitive hash rates. High-performance miners may not fully utilize their rigs due to outdated software. Some reports suggest that nearly 40% of miners fail to upgrade timely.

Moreover, user-friendly interfaces enhance accessibility. While many advanced users dive into technical configurations, beginners can feel overwhelmed. This discrepancy highlights a need for better educational resources. In a field so driven by technology, ensuring that all miners can effectively use software remains a challenge. Effective software will also need strong cybersecurity features, as the risk of attacks rises significantly.

Mining Bitcoin in 2026 requires a careful analysis of costs and returns. Electricity expenses will likely be a significant factor. As more miners join the network, competition increases, causing difficulty adjustments. This means more resources are needed and costs rise. You must find an affordable energy source to remain competitive.

Hardware costs are another concern. The technology evolves rapidly, leading to frequent updates. Miners must balance the initial investment with anticipated returns. Choosing the right equipment is crucial. You may face challenges regarding compatibility and efficiency. Analyze your options before committing to a purchase.

Additionally, market volatility complicates profitability. Bitcoin prices can fluctuate wildly. A sudden drop can erase any gains from mining efforts. Consider financial planning and have a safety net. Waiting for the right moment could be wise. Each decision can drastically impact your returns.