Leave Your Message

As the cryptocurrency landscape continues to evolve, "Cloud Mining" has emerged as a pivotal component of the digital asset ecosystem. According to industry reports, the global cloud mining market is projected to reach $1.4 billion by 2028, growing at a compound annual growth rate (CAGR) of 28.6% from 2021 to 2028. This rapid expansion highlights the increasing demand for accessible and cost-effective mining solutions, allowing investors to participate in cryptocurrency mining without the need for expensive hardware and considerable technical expertise. Furthermore, as traditional mining becomes less profitable due to rising energy costs and stringent regulations, cloud mining presents a viable alternative, enabling users to lease mining power and share in the rewards without the complexities of managing equipment.

Understanding the implications of cloud mining not only provides insight into its operational dynamics but also helps investors strategize effectively in an increasingly competitive market.

As the cryptocurrency landscape continues to evolve, "Cloud Mining" has emerged as a pivotal component of the digital asset ecosystem. According to industry reports, the global cloud mining market is projected to reach $1.4 billion by 2028, growing at a compound annual growth rate (CAGR) of 28.6% from 2021 to 2028. This rapid expansion highlights the increasing demand for accessible and cost-effective mining solutions, allowing investors to participate in cryptocurrency mining without the need for expensive hardware and considerable technical expertise. Furthermore, as traditional mining becomes less profitable due to rising energy costs and stringent regulations, cloud mining presents a viable alternative, enabling users to lease mining power and share in the rewards without the complexities of managing equipment.

Understanding the implications of cloud mining not only provides insight into its operational dynamics but also helps investors strategize effectively in an increasingly competitive market.

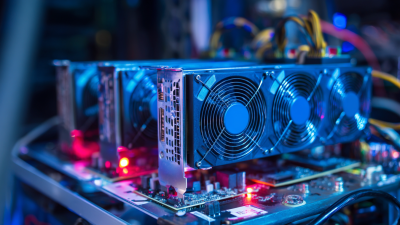

Cloud mining has emerged as a significant component of the cryptocurrency ecosystem, enabling users to participate in mining without the need for expensive hardware. By leasing computing power from a remote data center, users can engage in the mining of cryptocurrencies like Bitcoin, Ethereum, and Dogecoin. This approach not only democratizes access to mining but also mitigates the operational challenges associated with traditional mining methods, such as escalating costs and the complexity of proof-of-work protocols. Recent reports indicate a surge in cloud mining platforms, with an increase in user bases surpassing millions globally, highlighting the growing acceptance and reliance on this innovative model.

Tips: If you're considering entering cloud mining, it's crucial to research different platforms thoroughly. Look for factors such as user reviews, payout structures, and the transparency of operations. Additionally, be aware of market trends, as the value of cryptocurrencies can fluctuate significantly, which may impact your investment return.

As the cryptocurrency landscape continues to evolve, cloud mining's role in enabling larger segments of the population to engage in mining is becoming increasingly evident. Companies that provide these services are not only facilitating mining but also contributing to the development of a more inclusive financial ecosystem. Understanding the nuances of cloud mining can empower investors to make informed decisions, aligning their strategies with the broader market dynamics.

This bar chart depicts the growth in the number of global cloud mining users from 2019 to 2023. As illustrated, the rise in cloud mining has been substantial, reflecting a significant increase in cryptocurrency investments and participation in the cloud mining sector.

Cloud mining has emerged as an attractive option for investors looking to capitalize on the booming cryptocurrency market without the hefty upfront costs associated with traditional mining. Evaluating its benefits involves assessing factors such as cost-effectiveness, scalability, and ease of use. Unlike traditional mining, which requires significant investments in hardware and energy, cloud mining allows users to lease processing power from remote data centers, making it accessible to a broader audience.

Cloud mining has emerged as an attractive option for investors looking to capitalize on the booming cryptocurrency market without the hefty upfront costs associated with traditional mining. Evaluating its benefits involves assessing factors such as cost-effectiveness, scalability, and ease of use. Unlike traditional mining, which requires significant investments in hardware and energy, cloud mining allows users to lease processing power from remote data centers, making it accessible to a broader audience.

Tips: When considering cloud mining, it's essential to research the provider's reputation and track record. Look for reviews from other investors and verify the legitimacy of the service. Additionally, calculate the potential return on investment (ROI) by factoring in the cloud mining fees and projected earnings based on current market conditions.

Another critical aspect is the option of scalability in cloud mining services. Investors should consider whether the service allows easy upgrades in processing capacity as demand for cryptocurrency mining fluctuates. This flexibility can be a significant advantage in maximizing returns, allowing investors to adapt quickly to market trends without the need for substantial new investment.

Cloud mining has gained significant popularity among cryptocurrency investors as it offers a way to mine digital currencies without the need for expensive hardware. However, potential investors should be aware of the inherent risks and challenges associated with this investment vehicle. According to a report by Market Research Future, the global cloud mining market is expected to grow at a 17.8% CAGR from 2022 to 2027, which highlights the increasing interest in this field. Nonetheless, the decentralized nature of cryptocurrencies can pose risks, including the potential for scams and a lack of regulatory oversight.

Cloud mining has gained significant popularity among cryptocurrency investors as it offers a way to mine digital currencies without the need for expensive hardware. However, potential investors should be aware of the inherent risks and challenges associated with this investment vehicle. According to a report by Market Research Future, the global cloud mining market is expected to grow at a 17.8% CAGR from 2022 to 2027, which highlights the increasing interest in this field. Nonetheless, the decentralized nature of cryptocurrencies can pose risks, including the potential for scams and a lack of regulatory oversight.

One of the primary concerns with cloud mining investments is the sustainability of profitability. A study by Coin Metrics shows that mining profitability can be heavily influenced by factors such as energy costs, the price of cryptocurrencies, and mining difficulty. For instance, in 2021, Bitcoin mining rewards decreased by over 20% due to network changes, causing profit margins for cloud mining operations to tighten. Investors should perform thorough due diligence, evaluating the service provider's operational transparency, server locations, and user reviews to mitigate risks effectively. This informed approach can help investors navigate the complexities of cloud mining and protect themselves from potential losses.

When selecting the right cloud mining provider, investors must evaluate several critical factors to ensure they choose a reputable and efficient service. According to the latest industry reports, the global cloud mining market is expected to reach a valuation of USD 1.4 billion by 2027, driven by increased interest in cryptocurrency investments. With numerous providers flooding the market, understanding the technology and operational transparency of each service is essential. Ensuring that the provider has clear communication regarding fees, mining equipment, and contracts can significantly impact overall profitability and peace of mind.

Additionally, due diligence on the provider's track record is vital. Platforms like Hashrate Index highlight that only a handful of providers maintain a positive reputation, with many facing issues related to profitability and payout discrepancies. Investors should look for reviews and user testimonials, as well as verification of mining capability through independent audits. With cloud mining's inherent risks, understanding the specifics of what each provider offers can streamline the decision-making process and enhance your cryptocurrency investment strategy.

| Provider Type | Hash Power Offered (TH/s) | Maintenance Fee (%) | Minimum Contract Duration (Months) | Profitability (Monthly Avg Return) | Customer Support Rating (Out of 5) |

|---|---|---|---|---|---|

| ASIC Mining | 10 | 5 | 24 | 50% | 4.5 |

| GPU Mining | 5 | 10 | 12 | 30% | 4.0 |

| FPGA Mining | 3 | 7 | 18 | 40% | 4.8 |

| Cloud Pool Mining | 8 | 6 | 36 | 45% | 4.2 |

| Shared Mining | 6 | 8 | 6 | 25% | 4.0 |

Cloud mining has become an attractive strategy for cryptocurrency investors looking to optimize their portfolios without the substantial upfront costs of acquiring hardware. According to a recent report by Market Research Future, the global cloud mining market is projected to grow at a CAGR of 23.5% from 2021 to 2027, indicating a significant shift in how individuals engage with cryptocurrency mining. This trend allows investors to leverage remote data centers that handle the mining process, making it more accessible to those lacking advanced technical skills or substantial capital.

To enhance portfolio performance, investors can incorporate cloud mining based on specific criteria such as hash rate, operational costs, and the overall reliability of the service provider. A study by Allied Market Research revealed that the profitability of cloud mining can vary significantly depending on electricity costs and market volatility. By strategically selecting cloud mining contracts that offer competitive pricing and favorable terms, investors can ensure a more effective distribution of their assets, ultimately leading to enhanced returns in a rapidly evolving market.