Leave Your Message

The Cryptocurrency Market has become a hot topic for investors today. With rapid developments, many experts encourage participation. As Johnathan Miller, a noted cryptocurrency analyst, states, “Investing now could define your financial future.” This statement captures the urgency many feel towards entering this dynamic sector.

People are drawn to the potential profits in the Cryptocurrency Market. Assets like Bitcoin and Ethereum have shown strong performance. Yet, the market's volatility can be daunting. Investors must navigate risks while pursuing rewards. Many have seen fleeting gains, which raises questions about sustainability.

Engaging with the Cryptocurrency Market is not for the faint-hearted. There are challenges, but they come with opportunities. Beginners should conduct thorough research. Understanding market trends and technology is crucial.

Each choice influences long-term financial outcomes. As you consider your entry into this market, reflect on your goals and risk tolerance. The future of investing might very well depend on what you do today.

The cryptocurrency market is experiencing dynamic trends in 2023. Recent reports indicate that Bitcoin and Ethereum are leading the charge, with Bitcoin dominance reaching around 45%. This trend highlights the market's concentration on major players. Smaller altcoins, however, are exhibiting significant volatility. While this can pose risks, it also offers opportunities for traders willing to take calculated risks.

Data shows that institutional investment in cryptocurrencies has surged by over 300% in the past year. This influx is partly due to growing acceptance among financial institutions. Yet, this growth raises questions about market stability. Reports indicate that nearly 70% of new investors are individuals seeking quick returns. This speculative behavior can lead to market bubbles and volatility.

Furthermore, regulatory developments are influencing market trends. Governments worldwide are considering stricter regulations that could reshape the landscape. A recent study indicated that 58% of existing crypto investors anticipate increased regulation. This uncertainty may deter some, while attracting investors seeking a secure environment. The shifting dynamics force everyone to rethink their strategies.

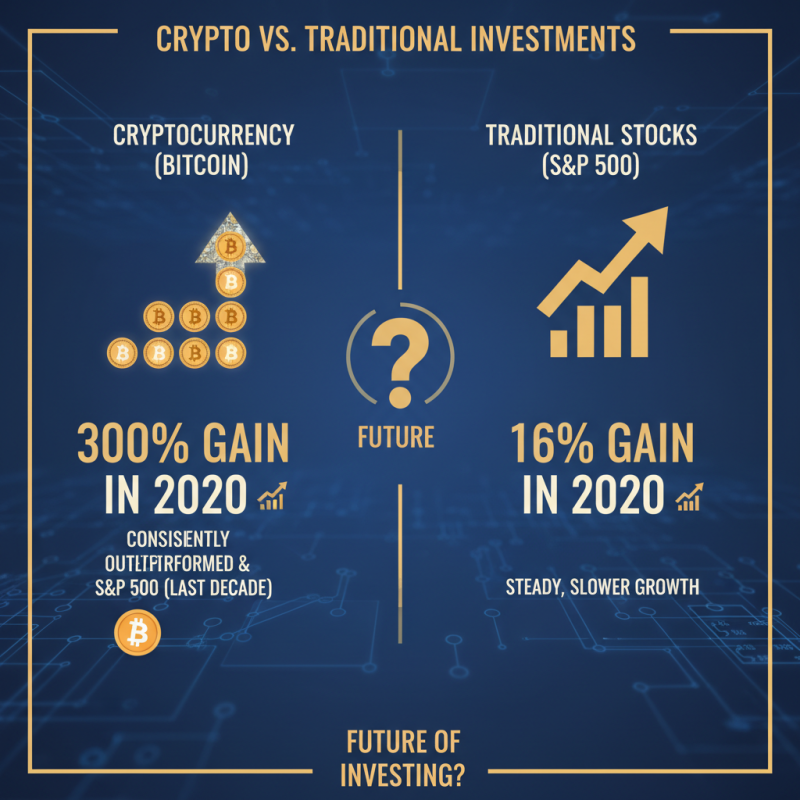

Investing in cryptocurrency offers a new horizon for potential returns, especially when compared to traditional investments. Historical data indicates that Bitcoin has outperformed the S&P 500 consistently over the past decade. In 2020, Bitcoin surged over 300%, while the S&P 500 saw a mere 16% increase. This stark contrast raises intriguing questions about the future of investment strategies.

Traders and investors often find cryptocurrencies more volatile. This volatility can lead to significant gains, but it also means risks. For example, Ethereum's price fluctuated from $200 to over $4,000 in just a year. Such rapid changes may deter some traditional investors, but savvy ones might see this as an opportunity. Research suggests that diversifying portfolios with a small percentage of cryptocurrency can enhance overall returns.

Tip: Always set a budget for crypto investments. Allocating only what you're comfortable losing can minimize stress.

Additionally, understanding the market dynamics is crucial. Unlike stocks, cryptocurrencies are influenced by diverse factors, including technology and market sentiment. This complexity could cause hesitation for traditional investors. However, embracing this challenge could lead to lucrative opportunities.

Tip: Stay updated with market trends. Regularly reviewing news can inform your investment decisions and provide valuable insights.

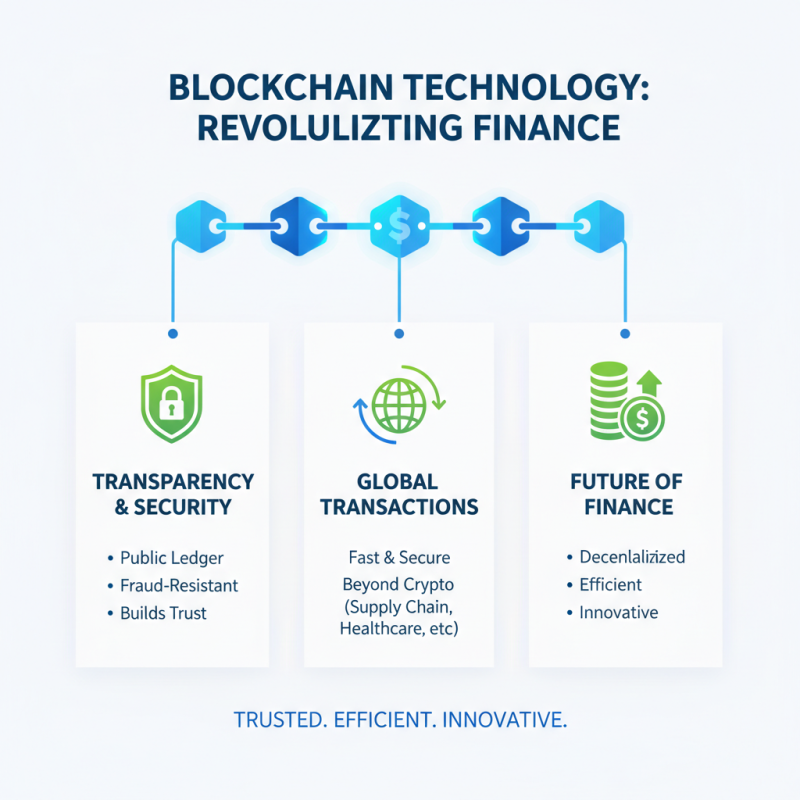

Blockchain technology is revolutionizing finance. It offers transparency and security unlike traditional systems. Transactions are recorded on a public ledger, making fraud nearly impossible. This innovation helps to build trust among users. It's not just about cryptocurrencies; blockchain can reshape various industries.

Consider how it impacts banking. With blockchain, cross-border transactions are faster and cheaper. It removes intermediaries, reducing costs for consumers. But this shift comes with challenges. Regulations are still catching up. Users must navigate these legal landscapes cautiously. Not every blockchain solution is perfect. Some may lack scalability or face security issues.

Tips: Research thoroughly before diving into blockchain projects. Look for teams with proven track records. Assess whether the technology truly solves a problem. Many projects may look appealing but lack substance. Stay skeptical and informed to make better investment choices.

Investing in cryptocurrency can seem enticing. However, potential investors must tread carefully. The market is highly volatile. In 2021, Bitcoin experienced a 300% surge, but the drop that followed was equally drastic. Such fluctuations can lead to significant losses.

Regulatory uncertainties pose another challenge. According to a report by Chainalysis, over 70% of countries are still developing their regulatory frameworks for cryptocurrencies. This uncertainty can impact market stability. Investors might find themselves facing sudden legal changes. Ignoring these factors could lead to unexpected consequences.

Security concerns cannot be overlooked either. A report from CipherTrace noted that over $1.9 billion was lost in crypto hacks in 2020 alone. This figure highlights the risks associated with online wallets and exchanges. Investors should implement strong security measures, yet security is never absolute. Technology evolves, and so do threats. Being aware of these challenges is crucial for informed investment decisions.

The cryptocurrency market is evolving rapidly. Predictions about its future are becoming more intriguing. Many experts believe that cryptocurrencies will gain wider acceptance. This could lead to increased investment opportunities. However, volatility remains a significant concern. Prices may swing dramatically, making it challenging to invest wisely.

Tip: Diversification is essential. Don't put all your funds into one coin. Spread your investments across various cryptocurrencies. This strategy can minimize risk, especially in a fluctuating market. Keep a lookout for new projects that show promise. Many emerging coins may offer significant returns, but research is key.

Investors should remain cautious. The market can present great opportunities, but it’s not without its pitfalls. Remember the boom and bust cycles. Some coins may outperform others, but not all will succeed. Always be ready to adjust your strategies. Staying informed about market trends is crucial for success.