Leave Your Message

As the cryptocurrency market continues to evolve, many investors are turning to Cloud Mining as a viable means to generate profits. According to a report by Grand View Research, the global cloud mining market is expected to experience a substantial growth rate, projected to reach $1.4 billion by 2025, driven by the increasing demand for crypto mining solutions that do not require extensive hardware investments.

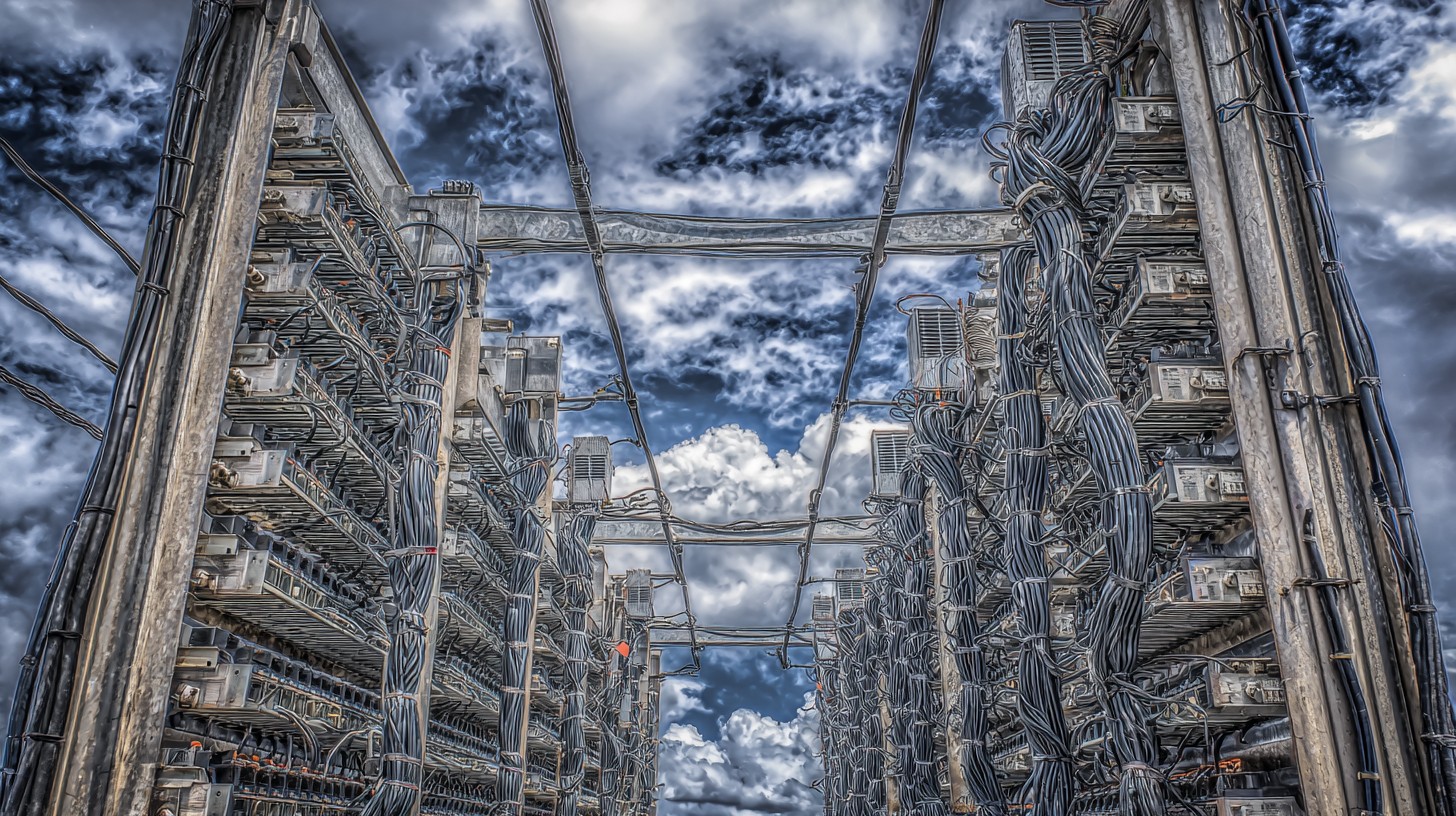

Cloud Mining offers a unique advantage by allowing users to rent mining power from a data center, thus eliminating the complexities and costs associated with managing physical mining operations. However, maximizing your profits through this strategy requires a thorough understanding of market trends, mining contracts, and the technological infrastructure behind these services. In this guide, we will explore effective strategies to optimize your returns in the competitive landscape of Cloud Mining.

When selecting a cloud mining platform, investors should focus on several key metrics to maximize their earning potential.

The rise of Bitcoin cloud mining has made it easier for individuals to earn passive income without the burden of managing hardware.

Choosing the right provider involves analyzing factors such as mining fees,

contract duration, payout frequency,

and the platform's reputation within the community.

Tips: Always check user reviews and the platform's history to gauge reliability.

A platform that offers transparent fees and clear terms of service can save you from unexpected costs later on.

Currently, some of the most effective cloud mining platforms of 2025 are recognized for their user-friendly interfaces

and robust customer service. Reports indicate that users can earn significant daily profits by leveraging these platforms,

with opportunities for returns exceeding $9,000 a month in ideal conditions.

As competition increases and mining difficulty escalates, aligning with a trusted provider becomes paramount;

look for platforms with a proven track record and favorable user experiences.

Tips: Experiment with small investments to gauge performance before committing larger sums.

Always stay updated on the latest trends and technological advancements in the industry to make informed decisions.

In the world of cloud mining, understanding your mining needs is paramount for maximizing profits. Key elements such as hash rate, return on investment (ROI), and energy consumption significantly influence your outcomes. For instance, a recent report from the Cambridge Centre for Alternative Finance reveals that effective hash rate management can lead to a revenue increase of over 50% when optimizing contracts based on geographical and energy considerations. Choosing a provider with competitive hash rates can ensure you're mining efficiently, thereby amplifying potential profits.

Moreover, ROI analysis is vital for potential investors. According to industry data from CoinDesk, the average ROI for cloud mining contracts can vary widely, ranging from 25% to over 150% annually, depending on several factors, including market volatility and contract duration. Energy consumption also plays a critical role; a study by the International Energy Agency indicates that data centers can account for up to 2% of global electricity use. Therefore, selecting a cloud mining service that prioritizes energy efficiency can reduce expenses without compromising performance, making it essential for achieving sustainable profit margins in the highly competitive mining ecosystem.

| Cloud Mining Provider | Hash Rate (TH/s) | Monthly Cost ($) | Monthly ROI (%) | Energy Consumption (kWh) | Profitability ($) |

|---|---|---|---|---|---|

| Provider A | 15 | 200 | 10% | 1200 | 50 |

| Provider B | 20 | 250 | 12% | 1500 | 60 |

| Provider C | 10 | 150 | 15% | 800 | 40 |

| Provider D | 25 | 300 | 8% | 2000 | 70 |

Diversification is a crucial strategy in the realm of cloud mining, especially when aiming to balance different cryptocurrencies for optimal returns. According to a report by the Cambridge Centre for Alternative Finance, as of 2022, Bitcoin controlled approximately 41% of the total cryptocurrency market, but the remaining altcoins present a substantial opportunity for diversification. For instance, Ethereum and Cardano have shown impressive growth and technological advancements that can lead to significant profits in a cloud mining portfolio.

Investing in a range of cryptocurrencies can mitigate risks associated with market volatility. Historical data indicates that during the 2021 bull market, the top 10 altcoins outperformed Bitcoin, with returns exceeding 1000% (Messari, 2021). By strategically mining different cryptocurrencies, investors can capture those spikes in value while insuring against potential downturns in any single asset. A balanced portfolio that includes a mix of established and emerging cryptocurrencies can enhance overall profitability and provide a buffer against the inherent volatility in the cryptocurrency market. This approach not only maximizes potential profits but also creates a more stable investment landscape in the ever-evolving world of cloud mining.

Cloud mining has revolutionized the way individuals engage with cryptocurrency mining, providing an accessible platform that eliminates the need for expensive hardware and technical know-how. One of the best strategies to maximize profits in cloud mining is to leverage automation and various tools that enhance efficiency. By integrating automated systems, miners can manage their operations around the clock, ensuring optimal performance without constant manual oversight. This can mean scheduling tasks during peak hours for optimal resource use or automatically reallocating power to maximize returns.

In addition to automation, utilizing monitoring tools is essential for tracking the performance of your mining operations. These tools provide real-time data on energy consumption, profitability metrics, and system health, allowing miners to make informed decisions quickly. With comprehensive analytics, miners can identify trends and adjust their strategies accordingly, benefiting from historical data that can predict future performance. By combining automation with robust monitoring tools, miners not only streamline their processes but also enhance their ability to respond to market volatility, ultimately leading to increased profitability in the competitive world of cloud mining.

In the rapidly evolving world of cloud mining, staying informed about market trends and utilizing analytics can significantly impact your profitability. Analysts suggest that leveraging tools such as real-time data feeds and predictive analytics can enhance decision-making. According to a recent report from a well-known industry analysis firm, companies that integrate data science techniques see a 20% increase in operational efficiency. By analyzing factors such as mining difficulty, coin prices, and market sentiment, miners can adjust their strategies to maximize returns.

Tips: Regularly monitor crypto market fluctuations and employ data visualization tools to identify patterns. Engage with analytics platforms that provide historical data to forecast future trends, enabling smarter investment decisions.

Furthermore, understanding the distinction between data science and machine learning is crucial for cloud miners. While data science encompasses the broader skill of extracting insights from data, machine learning focuses on creating algorithms to predict outcomes. The integration of machine learning models can lead to optimized mining operations by automating processes and improving resource allocation. Research indicates that implementing machine learning strategies can enhance predictive accuracy by as much as 30%, thus allowing miners to focus on the most profitable opportunities.

Tips: Consider investing in machine learning training or tools that can help analyze your mining operations and extract valuable insights from large datasets.