Leave Your Message

As the cryptocurrency market continues to evolve, many investors are seeking efficient and profitable methods for mining digital currencies. Among the various options available, investing in ASIC miners has emerged as a compelling choice for both seasoned and novice investors. According to a recent report by Bitinfocharts, the average hashrate in the Bitcoin network reached an all-time high of 200 EH/s in 2023, emphasizing the crucial role that specialized hardware plays in ensuring competitive mining operations. As highlighted by expert Dr. Jane Liu, a leading authority in the field of blockchain technology, “The efficiency and processing power of ASIC miners not only optimize mining yields but also significantly lower operational costs, making them an essential tool for any serious miner.”

Furthermore, with advancements in ASIC technology, miners can now achieve higher levels of performance while consuming less energy. A study by Cambridge Centre for Alternative Finance indicates that energy consumption related to Bitcoin mining has been decreasing due to improvements in ASIC miner design. This added efficiency is not just about maximizing profit margins—it's also about addressing the increasing scrutiny on energy usage in the crypto space. Thus, the importance of ASIC miners in the cryptocurrency landscape cannot be overstated, as they represent a bridge between the potential for investment growth and the need for sustainable practices. As the cryptocurrency market continues to mature, the strategic investment in ASIC miners becomes not just advantageous, but essential.

ASIC miners, or Application-Specific Integrated Circuit miners, are specialized hardware designed exclusively for cryptocurrency mining. Unlike general-purpose hardware like CPUs or GPUs, ASIC miners are engineered to perform a specific task with maximum efficiency. This specialization enables them to solve complex cryptographic puzzles faster and consume less energy than their counterparts, making them a preferred choice for serious miners aiming to maximize their return on investment.

The functionality of ASIC miners lies in their architecture, which is tailored for hashing specific algorithms used in various cryptocurrencies. When a miner attempts to add a new block to the blockchain, they must solve a mathematical problem that requires substantial computational power. ASIC miners excel in this arena by delivering higher hash rates, resulting in quicker block solving times and increased chances of earning rewards. Their streamlined design not only helps in being more energy-efficient but also reduces operational costs, which can significantly impact overall profitability in the competitive landscape of cryptocurrency mining.

When it comes to cryptocurrency mining, the choice of hardware is crucial to maximizing profitability and efficiency. ASIC miners, or Application-Specific Integrated Circuit miners, have emerged as the dominant choice, especially when compared to traditional GPU (Graphics Processing Unit) and CPU (Central Processing Unit) mining techniques. According to a report by the Cambridge Centre for Alternative Finance, ASIC miners can achieve hash rates that are orders of magnitude higher than their GPU and CPU counterparts. For instance, while a high-end GPU may provide around 30 MH/s for Ethereum mining, an ASIC miner can reach up to 2000 MH/s, making it a vastly superior option for serious miners looking to optimize their operations.

One of the primary advantages of ASIC miners is their energy efficiency. Research indicates that ASICs can perform mining operations with an energy cost of as low as 0.05 J/GH, compared to 1.5 J/GH for GPUs. This significant difference means that as energy prices fluctuate, ASIC miners are less vulnerable to rising utility costs, bolstering their profitability in the long run. Moreover, as the cryptocurrency space evolves, ASICs maintain a competitive edge due to their tailored design, allowing them to adapt to specific algorithms, thereby enhancing processing speeds and reducing downtime.

Tips: If considering investing in ASIC miners, assess your electricity costs and choose a model that aligns with your budget. Additionally, do thorough research on the best mining pools to join, as they can significantly impact your overall earnings. Lastly, keep abreast of market trends, as fluctuations in cryptocurrency values can affect the ROI of your mining operations.

ASIC miners demonstrate superior hashrate performance compared to GPU and CPU mining techniques, making them a more efficient choice for cryptocurrency mining.

As the cryptocurrency market continues to evolve, the profitability of mining operations is heavily influenced by technological advancements, particularly in the realm of ASIC (Application-Specific Integrated Circuit) miners. Recent market trends indicate a significant shift, with ASIC miners dominating the landscape due to their superior efficiency and performance. According to a report by Bitwise Asset Management, the return on investment (ROI) for dedicated ASIC miners can be substantially higher compared to older mining technologies. For instance, the energy efficiency of new ASIC models has improved by over 30% in the past year, translating into lower operational costs and increased profit margins for miners.

Investment in ASIC miners aligns with the current trends in the crypto market, where mining difficulty remains on an upward trajectory. A 2023 analysis by Blockchain.com shows that the Bitcoin mining difficulty has surged by 12% over the past six months, illustrating a competitive environment where only the most efficient mining operations can thrive. Miners who invest in ASIC hardware can expect to achieve breakeven points more rapidly, often within six to twelve months, depending on their electricity costs and the current price of cryptocurrencies. This combination of enhanced efficiency and the potential for quicker ROI makes ASIC miners a compelling option for both new and experienced miners looking to capitalize on the ongoing cryptocurrency boom.

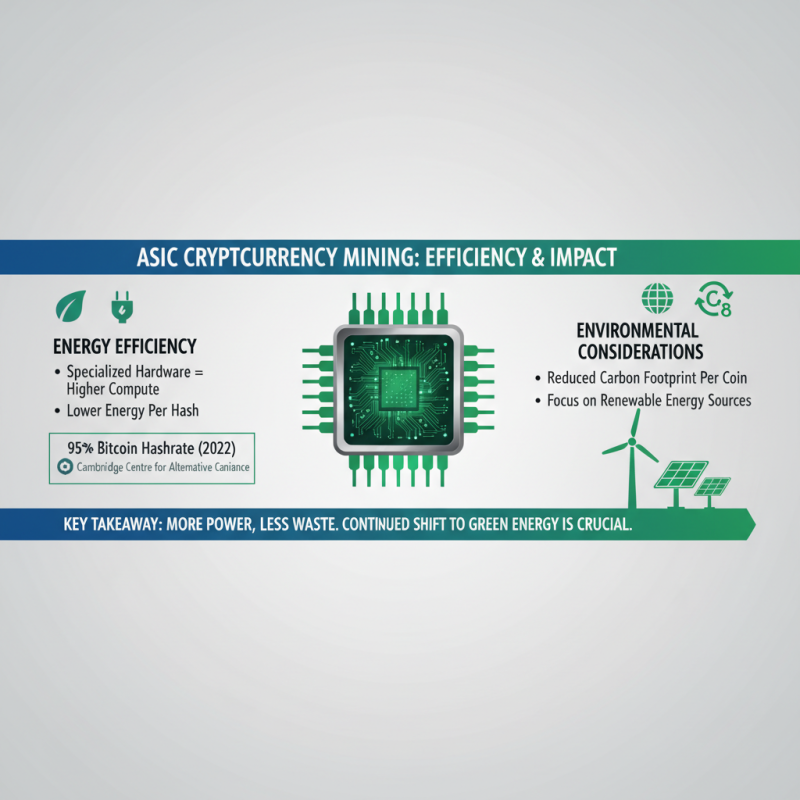

The environmental impact and energy efficiency of ASIC mining equipment have become pivotal topics in the cryptocurrency mining industry. ASIC miners, or Application-Specific Integrated Circuits, are designed specifically for cryptocurrency mining, enabling them to perform complex calculations at a significantly higher rate than generalized computing devices. According to a report by the Cambridge Centre for Alternative Finance, as of 2022, ASIC miners accounted for over 95% of the network hash rate for Bitcoin, emphasizing their dominance in the market. This efficiency translates not only into higher output but also a reduction in energy consumption per unit of computational power.

Moreover, the efficiency of ASIC miners plays a crucial role in sustainability efforts. These devices are engineered to minimize energy waste, often achieving energy efficiency ratings as high as 0.5 joules per gigahash (J/GH) in the latest models. For comparison, older mining rigs can consume upwards of 1.5 J/GH. The adoption of ASIC miners can therefore significantly decrease the carbon footprint of mining operations. A report from the International Energy Agency highlights that optimizing energy use in cryptocurrency mining could reduce global electricity consumption by up to 20% if widespread adoption of energy-efficient technologies occurs. Thus, investing in ASIC miners not only enhances potential profitability but also aligns mining practices with growing environmental considerations.

The landscape of cryptocurrency mining is continuously evolving, driven by advancements in ASIC technology. Future developments in this field promise to enhance mining efficiency and reduce energy consumption significantly. Innovations such as multi-chip integration and improved thermal management systems are anticipated, allowing miners to achieve higher hash rates without a proportional increase in power usage. These enhancements could lead to more affordable mining operations, appealing to both new and seasoned investors looking for sustainable returns in the cryptocurrency market.

Furthermore, the integration of artificial intelligence and machine learning into ASIC mining rigs holds great potential. By employing smart algorithms to optimize performance and adapt to changing network conditions, miners can maximize profitability. This shift toward intelligent mining solutions not only streamlines operations but also positions ASIC miners as vital players in a more competitive and environmentally conscious sector. As these technologies develop, the potential for increased adaptability and efficiency makes investing in ASIC miners an attractive proposition for those looking to capitalize on the future of cryptocurrency mining.