Leave Your Message

The Cryptocoin Market has rapidly evolved over the past decade, becoming a significant component of the global financial landscape. As investors seek to navigate this complex and often volatile environment, adhering to expert advice can be immensely beneficial. According to renowned digital currency expert Dr. Laura Jensen, "Success in the Cryptocoin Market requires not just knowledge, but also a strategic approach to risk management and market analysis." This underscores the importance of understanding the intricacies of digital currencies and the principles that govern their trading.

In this dynamic market, investors are faced with a myriad of options and opportunities, but also with considerable risks. Developing a well-informed strategy is essential to not only protect one's investments but also to capitalize on the potential rewards. By leveraging insights from experienced professionals and employing effective tactics, individuals can enhance their chances of success in the Cryptocoin Market. As we delve into the ten essential tips for navigating this market, it's crucial to consider both the opportunities and challenges that lie ahead, equipping oneself to make educated decisions in this ever-evolving field.

Cryptocurrency has emerged as a disruptive technology, fundamentally altering our understanding of finance and transactions. At its core, cryptocurrency relies on blockchain technology—a decentralized ledger that ensures transparency and security. As of 2023, the global cryptocurrency market capitalization has surged to over $2 trillion, with Bitcoin and Ethereum leading the charge. Understanding the basics of these technologies is crucial for anyone looking to navigate the market effectively.

One essential tip for prospective investors is to take the time to familiarize yourself with the underlying principles of blockchain. According to a report from the World Economic Forum, by 2027, blockchain technology is expected to be a foundational layer of the digital economy, with applications far beyond just cryptocurrency. This foundation empowers individuals to grasp how cryptocurrencies operate, allowing for more informed investment decisions.

Another vital piece of advice is to stay updated with the regulatory landscape surrounding cryptocurrencies. Recent findings highlight that over 40% of investors cite regulatory uncertainty as a major barrier to their engagement in the market. Monitoring policy changes can help you avoid potential pitfalls and capitalize on new opportunities. Ultimately, a solid understanding of cryptocurrency fundamentals, alongside a proactive approach to market trends, can greatly enhance your chances of navigating this complex and rapidly evolving landscape successfully.

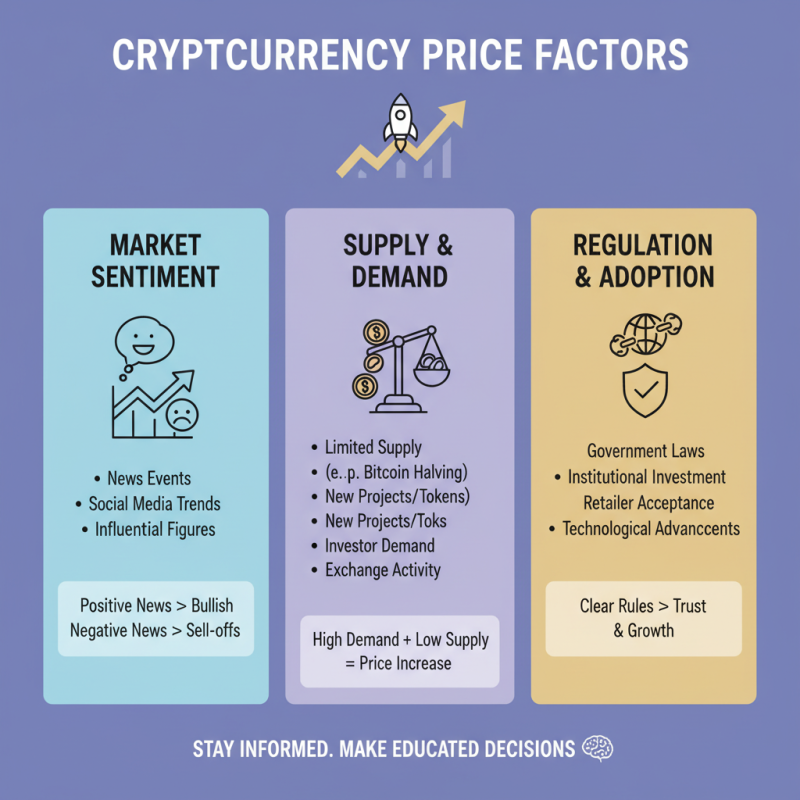

Understanding the key factors that influence cryptocoin prices is crucial for anyone looking to navigate the market successfully. One of the primary factors is market sentiment, which can be swayed by news events, social media trends, and influential figures within the crypto community. Positive developments, such as regulatory approval or major partnerships, can lead to bullish trends, while negative news can trigger sell-offs. Therefore, keeping abreast of current events and analyzing the prevailing mood in the market is essential for making informed investment decisions.

Another significant factor is the technological advancements and overall utility of a particular cryptocoin. Innovations, such as improvements in transaction speed and security, can enhance a coin's attractiveness, leading to increased demand and higher prices. Additionally, coins that solve real-world problems or offer unique functionalities are more likely to gain traction among users and investors. Consequently, conducting thorough research on the technology behind different coins and understanding their use cases is vital for assessing their long-term value in the rapidly evolving crypto landscape.

Developing a robust risk management strategy is crucial for anyone looking to invest in the volatile world of cryptocurrencies. One of the foundational steps in this process is to clearly define your risk tolerance. Understanding how much risk you are willing to take can significantly influence your investment choices. This entails assessing your financial situation and determining how much capital you can afford to lose. Setting limits on investment amounts for each trade and utilizing stop-loss orders can help manage potential losses, allowing investors to preserve their capital in the turbulent market.

Additionally, diversification is a vital component of any effective risk management strategy. Instead of concentrating your investments in a single coin, spreading your funds across multiple cryptocurrencies can reduce the overall risk associated with market fluctuations. By diversifying, you can protect yourself from significant downturns in any one asset while taking advantage of the growth potential in others. Finally, staying informed about market trends and regularly reviewing your portfolio will enable you to adjust your strategy as necessary, ensuring that you are not only safeguarding your investments but also positioning yourself for future growth opportunities.

| Tip Number | Tip Description | Importance Level |

|---|---|---|

| 1 | Conduct thorough research before investing. | High |

| 2 | Diversify your investment portfolio. | High |

| 3 | Stay updated on market trends and news. | Medium |

| 4 | Set a budget for your investment. | High |

| 5 | Understand the technology behind the coins. | Medium |

| 6 | Use a reliable and secure wallet. | High |

| 7 | Implement a risk management strategy. | High |

| 8 | Be wary of hype and scams. | High |

| 9 | Have a clear exit strategy. | Medium |

| 10 | Consider professional advice for large investments. | Medium |

Understanding the nuances of the cryptocoin market is crucial for successful trading and investment. Utilizing technical and fundamental analysis can significantly enhance your decision-making process. Technical analysis revolves around price charts and past market movements. By studying various indicators such as moving averages, RSI, and MACD, traders can identify trends and potential reversal points. One key tip is to always set up support and resistance levels before entering a trade, as these levels can provide insight into when to buy or sell.

On the other hand, fundamental analysis involves assessing the underlying value of a cryptocurrency, including factors such as the project's technology, team, and market demand. An essential tip here is to keep abreast of news and developments relating to the cryptocurrencies you are interested in. Market sentiment can be heavily influenced by events such as regulatory announcements or technological advancements. By staying informed, you can make confident decisions based on the true potential of a coin rather than relying solely on market hype. Diversifying your analysis approach by combining both technical and fundamental insights can ultimately lead to more informed trading strategies and better investment outcomes.

Navigating the cryptocoins market requires a solid understanding of various trading strategies that can help mitigate risks and maximize potential gains. One common strategy is

day trading, which involves purchasing and selling cryptocurrencies within the same day to take advantage of short-term price fluctuations.

For successful day trading, traders must stay well-informed about market news and trends, utilizing technical analysis to make quick decisions. Keeping a close eye on price charts and utilizing stop-loss orders can protect investments from sudden downturns.

For successful day trading, traders must stay well-informed about market news and trends, utilizing technical analysis to make quick decisions. Keeping a close eye on price charts and utilizing stop-loss orders can protect investments from sudden downturns.

Another effective approach is

HODLing, a strategy where investors buy and hold onto their cryptocurrencies for an extended period, regardless of market volatility.

This long-term investment perspective can be beneficial for those who believe in the underlying value of certain coins. HODLers often focus on fundamental analysis, looking at project developments and overall market trends to determine the best times to buy. Remember to assess your risk tolerance and investment goals carefully before engaging in this strategy.

This long-term investment perspective can be beneficial for those who believe in the underlying value of certain coins. HODLers often focus on fundamental analysis, looking at project developments and overall market trends to determine the best times to buy. Remember to assess your risk tolerance and investment goals carefully before engaging in this strategy.

Lastly, consider implementing

dollar-cost averaging (DCA), which involves investing a fixed amount of money into cryptocurrencies at regular intervals.

This strategy helps to reduce the impact of market volatility and avoids the pitfalls of trying to time the market. By spreading out purchases, investors can accumulate coins over time, potentially leading to a more favorable average price. Regardless of the strategy you choose, continuously educating yourself and staying updated on market trends will significantly enhance your trading experience.

This strategy helps to reduce the impact of market volatility and avoids the pitfalls of trying to time the market. By spreading out purchases, investors can accumulate coins over time, potentially leading to a more favorable average price. Regardless of the strategy you choose, continuously educating yourself and staying updated on market trends will significantly enhance your trading experience.