Leave Your Message

The Cryptocoin Market has emerged as a revolutionary force in finance. With a market capitalization exceeding $2 trillion in 2023, this sector captivates investors and tech enthusiasts alike. The allure of Cryptocoins stems from their decentralized nature and potential for high returns. According to a recent report by Market Research Future, the market is expected to grow at a CAGR of over 25% from 2023 to 2030.

Industry expert Dr. Jane Smith states, "The Cryptocoin Market represents a new frontier in digital finance, blending innovation with investment." Despite its allure, the market is not without pitfalls. High volatility and regulatory ambiguity pose significant challenges for new investors. A careful approach is essential as many still struggle to grasp the technology behind Cryptocoins.

As the Cryptocoin Market continues to evolve, it offers numerous opportunities. However, the complexities and risks involved should not be overlooked. Educating oneself about the underlying principles is critical. The road ahead may be fraught with obstacles, but the potential benefits are too compelling to ignore.

Cryptocoins, often referred to as cryptocurrencies, are digital assets designed for secure transactions. They utilize blockchain technology, which enhances transparency and security. Each transaction is recorded on numerous computers worldwide, making tampering nearly impossible. This decentralized nature allows users to trust the system without needing a central authority.

The primary purpose of cryptocoins is to facilitate peer-to-peer transactions. This innovation challenges traditional banking and transfer methods. Users can send money across borders quickly and often with lower fees. However, there are risks involved. The market is known for its volatility. Prices can swing wildly in short periods. New investors need to be cautious and aware of these fluctuations.

While the concept is revolutionary, it is not without complications. Many people have lost money due to market manipulation and scams. The technology itself can be daunting for newcomers. There is a constant need for better understanding among users. Cryptocoins might seem like the future, but they require careful consideration and reflection before getting involved.

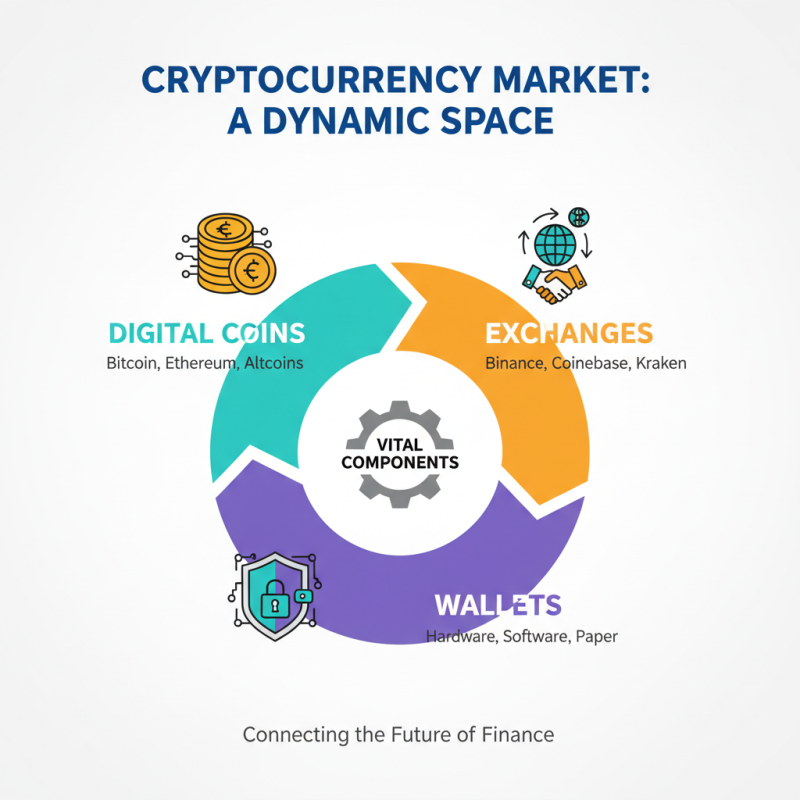

The cryptocoin market is a dynamic space. It consists of various components. These include digital coins, exchanges, and wallets. Each plays a vital role in how the market functions.

Digital coins are the core of this market. They serve as units of value. Bitcoin, for instance, remains popular, but thousands of others exist. This diversity offers choices for investors.

Exchanges are platforms where buying and selling occur. They can be centralized or decentralized. Centralized exchanges offer convenience, but they require trust. Decentralized exchanges provide more privacy, yet can be complex to navigate.

**Tip:** Always research exchange security measures before trading. Wallets are essential for storing coins. They come in various forms, like hardware or software. Each has its pros and cons. Finding the right wallet involves evaluating security and accessibility.

**Tip:** Prioritize security. Reflect on how much risk you can handle when choosing a wallet. The market is volatile. Prices can go up and down rapidly. It’s crucial to educate yourself and stay informed.

Cryptocoins are digital assets created through various means. The two primary methods are mining and initial coin offerings (ICOs).

Mining involves solving complex mathematical problems to validate transactions on a blockchain. Miners contribute computing power to the network, and in return, they receive new coins. This process is energy-intensive and requires significant resources. Some criticize it for its environmental impact.

On the other hand, ICOs offer a different route for creating cryptocoins. They give developers a chance to raise funds by selling tokens at the project’s inception. Investors purchase these tokens, hoping to profit once the project gains traction. However, ICOs can be risky. Many projects lack transparency and can fail to deliver on promises.

Both methods have their pros and cons. Mining can be rewarding but unsustainable. ICOs provide opportunities but can lead to losses. Because of the volatile nature of the market, investors should conduct thorough research before diving in. It's essential to reflect on the risks involved in each approach.

Cryptocoin trading largely occurs through exchanges. These platforms serve as intermediaries. Users can buy, sell, or trade various digital currencies. Each exchange operates differently, with unique user interfaces and transaction fees. Some are user-friendly, while others may overwhelm beginners.

Liquidity is a crucial element in this market. High liquidity means easy transactions without significant price changes. However, not all exchanges provide this. Users must carefully choose where to trade to ensure smooth operations. Price discrepancies often arise too. A coin's value may differ on platforms due to varying supply and demand levels.

Security also poses challenges. Exchanges face risks of hacking and fraud. Users must remain vigilant and research exchanges thoroughly. Some platforms provide insurance for assets, but this is not universal. It’s important to recognize that not every exchange prioritizes user safety. This can lead to frustration when access to funds is unexpectedly restricted.

| Cryptocoin | Market Capitalization ($ Billion) | 24h Trading Volume ($ Billion) | Price ($) | Circulating Supply (Million) |

|---|---|---|---|---|

| Bitcoin | $450 | $30 | $50,000 | 18,600 |

| Ethereum | $220 | $20 | $3,500 | 115,000 |

| Binance Coin | $70 | $2.5 | $400 | 150,000 |

| Cardano | $40 | $1.5 | $1.50 | 31,000 |

| Solana | $30 | $3 | $100 | 300 |

The value of cryptocurrencies can shift dramatically. Many factors influence these changes. Market demand plays a crucial role. When more people want to buy a coin, its price rises. Conversely, if interest wanes, prices can drop.

Regulatory news heavily impacts values. Positive regulations can boost confidence. On the other hand, negative news can cause panic. Traders often react swiftly to these developments. Additionally, technological advancements can drive interest, causing spikes in value. For instance, new features or updates can attract attention.

Investor sentiment also matters greatly. If traders feel optimistic, they are likely to invest more. Fear can lead to selling, impacting prices quickly. Overall, understanding these factors is essential for anyone in the cryptocoin market. It's a complex landscape that requires careful navigation.