Leave Your Message

As the cryptocurrency market continues to evolve, cloud mining stands out as a promising avenue for investors seeking to capitalize on digital assets without the complexities of traditional mining operations. According to a report by Market Research Future, the global cloud mining market is expected to grow at a compound annual growth rate (CAGR) of approximately 27% from 2021 to 2027, reaching a valuation of over $1.4 billion. This remarkable growth is driven by the rising accessibility of cloud-based solutions for mining, enabling both novice and experienced investors to participate in the lucrative cryptocurrency ecosystem.

Furthermore, the increasing shift towards decentralized finance (DeFi) and the growing interest in sustainable mining practices underscore the significant potential of cloud mining to unlock profits in the ever-expanding cryptocurrency landscape. As investors seek efficient and scalable solutions, understanding the future of cloud mining becomes crucial for maximizing returns in this dynamic market.

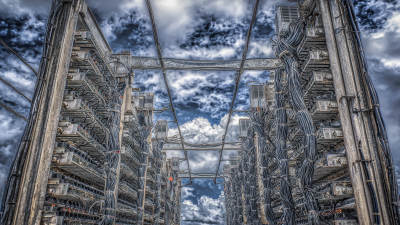

The landscape of cryptocurrency investing has undergone significant transformation, particularly with the rise of cloud mining. Originally, mining required substantial upfront investment in hardware and energy costs, making it accessible primarily to tech-savvy individuals or those with deep pockets. However, cloud mining has democratized access to cryptocurrency mining by allowing users to rent mining power from remote data centers. This evolution not only lowers the entry barrier for investors but also shifts the focus from managing physical hardware to simply choosing a reliable cloud mining service.

Tips: When selecting a cloud mining provider, thoroughly research their reputation and user reviews. It's essential to understand the fee structure, potential profits, and any risks involved. Additionally, consider services that offer transparent operations, giving you insights into where and how your investments are being utilized.

As cloud mining continues to evolve, it adapts to advancements in technology and market dynamics. Innovations such as eco-friendly mining solutions are emerging, appealing to environmentally-conscious investors. The future of cloud mining looks promising, with the potential for enhanced scalability and profitability, making it a viable option for both newcomers and seasoned investors looking to diversify their portfolios.

Tips: Keep an eye on market trends and advancements in blockchain technology, as these can influence the profitability of cloud mining. Using multiple mining pools can also spread risk and increase your chances of consistent returns.

Cloud mining has emerged as a revolutionary mechanism in the cryptocurrency investment landscape, allowing users to mine digital currencies without the need for extensive hardware or technical expertise. By leveraging remote data centers, investors can participate in mining pools that enhance their earning potential. Recent reports indicate that cloud mining platforms can facilitate daily earnings of up to $9 for Bitcoin and XRP, underscoring the accessibility and revenue generation prospects this model offers.

Cloud mining has emerged as a revolutionary mechanism in the cryptocurrency investment landscape, allowing users to mine digital currencies without the need for extensive hardware or technical expertise. By leveraging remote data centers, investors can participate in mining pools that enhance their earning potential. Recent reports indicate that cloud mining platforms can facilitate daily earnings of up to $9 for Bitcoin and XRP, underscoring the accessibility and revenue generation prospects this model offers.

Moreover, with Ethereum regaining momentum and surpassing $4,200, cloud mining for ETH holders has demonstrated significant profit potential, with estimates suggesting a monthly revenue capacity that could reach $58,000. This aligns with broader data illustrating the increasing profitability of mining as the cryptocurrency market matures. According to industry analysts, as the demand for cryptocurrencies continues to rise, cloud mining can serve as a valuable tool for both seasoned investors and newcomers looking to capitalize on market trends without the burdens of traditional mining.

Cloud mining has emerged as a popular option for investors looking to engage in cryptocurrency without the need for extensive hardware investments. One key advantage of cloud mining is its accessibility; it allows individuals to participate in Bitcoin and altcoin mining through remote data centers. This method eliminates the complexities of maintaining physical mining equipment and is less affected by changes in power costs. Furthermore, it provides the opportunity to scale investments more easily, as users can rent additional hashing power based on their budget and financial goals.

However, investors must also navigate the risks associated with cloud mining. The primary concern is the presence of scams and unreliable service providers. Many cloud mining contracts can be misleading, leading to potential losses if a company's operations are not transparent or profitable. Additionally, fluctuating cryptocurrency prices can adversely affect the profitability of cloud mining endeavors.

**Tips**:

1. Research thoroughly before committing to any cloud mining service. Look for reviews and user experiences to gauge reliability.

2. Start with a small contract to test the waters, minimizing potential losses while getting acquainted with how cloud mining operates.

3. Keep an eye on market trends and cryptocurrency valuations, as these can significantly impact your returns.

The landscape of cloud mining is evolving rapidly, shaped by technological advancements and shifting market dynamics. The integration of artificial intelligence and machine learning into cloud mining platforms is set to optimize mining operations, enhancing efficiency and profitability. These technologies allow for real-time data analysis and predictive modeling, ensuring miners can adapt swiftly to market fluctuations. As a result, miners may enjoy lower operational costs while maximizing their returns.

Moreover, the increasing adoption of renewable energy sources in cloud mining presents a significant trend that aligns with global sustainability goals. Miners are increasingly aware of their carbon footprint, driving the shift towards eco-friendly operations. Companies that invest in green technology not only appeal to environmentally-conscious investors but also position themselves advantageously in a market that values sustainability. This blend of technology and environmental responsibility could redefine the cloud mining sector, making it more resilient and attractive to future investors.

As the cryptocurrency landscape evolves, a comparative analysis of cloud mining versus traditional mining methods reveals significant differences in profitability and accessibility. According to a report by Statista, the global cloud mining market was valued at approximately $1 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of 11.2% from 2021 to 2028. This growth highlights the appeal of cloud mining, where users can lease mining power without the hefty upfront costs associated with traditional mining rigs, which can run upwards of several thousand dollars.

Traditional mining, while still effective, requires substantial investments in hardware, electricity, and maintenance. The Cambridge Centre for Alternative Finance indicates that energy consumption for Bitcoin mining in 2022 was around 100 terawatt-hours, amidst increasing concerns about its environmental impact. In contrast, cloud mining services inherently offer a more sustainable solution, as providers often utilize renewable energy sources and advanced cooling technologies, mitigating the significant carbon footprint of traditional operations. As amateur and seasoned investors seek cost-effective avenues for entering crypto, cloud mining stands to reshape the profitability dynamics in the industry, making it an increasingly attractive option.