Leave Your Message

In the ever-evolving world of cryptocurrency, choosing the right Asic Miner is crucial. Experts in the field have varied insights into this decision. John F., a renowned crypto mining specialist, once stated, "The right equipment can make or break your mining success." This highlights the significance of selecting an efficient miner tailored to your needs.

When considering an Asic Miner, it's essential to evaluate factors like hash rate, power consumption, and price. Many miners make hasty choices, often skipping research. An uninformed selection can lead to substantial losses. For instance, different miners perform differently in varying environments.

Finding the perfect Asic Miner requires careful thought and research. This can be daunting, especially for newcomers. The market is flooded with options, making it easy to overlook critical specifications. Striking a balance between performance and cost often proves challenging. Reflection on personal mining goals is vital for a wise decision.

ASIC miners are specialized devices designed for cryptocurrency mining. They stand out for their efficiency and power. This technology has revolutionized the mining landscape. Compared to traditional GPUs, ASICs offer significantly higher hash rates. This translates to faster and more profitable mining processes. However, they come with limitations.

One key drawback is their high upfront cost. Investing in an ASIC miner requires careful financial planning. Individuals need to evaluate their mining goals. If you're looking for serious profitability, ASIC miners can be a worthwhile investment. Yet, newer models are frequently being released. This rapid growth can make older models quickly obsolete. It's crucial to stay updated.

The energy consumption of ASIC miners is another aspect to consider. While they provide enhanced efficiency, they draw substantial power. This can lead to high electricity bills that might offset your profits. Therefore, ensure you assess your local energy costs and availability. When choosing an ASIC miner, weigh all factors carefully. This includes costs, efficiency, and your specific needs in the cryptocurrency market.

When choosing an ASIC miner, key specifications play a crucial role. Hashrate is one of the most important metrics. It determines how many calculations the miner can perform per second. Higher hashrates generally lead to increased chances of earning rewards. However, consider the energy efficiency too. A miner with high hashrate but poor energy performance might not be cost-effective.

Another essential aspect is the operating temperature. ASIC miners generate significant heat during operation. Maintaining optimal temperatures can prolong the device's lifespan. Cooling solutions might be necessary to manage heat. Look for miners that can efficiently handle heat dissipation. Additionally, check the power consumption. It directly impacts operational costs. Miners that use less energy for the same hashrate can save you money in the long run.

Compatibility with your chosen cryptocurrency is vital as well. Some miners are optimized for specific coins. Understanding which coins you plan to mine helps narrow down your options. Lastly, assess build quality and manufacturer support. A sturdy build ensures durability. Reliable customer service can assist with any issues that arise. Always research user experiences. It’s beneficial to learn from others’ triumphs and challenges when selecting your ASIC miner.

When selecting an ASIC miner, efficiency and hash rate are pivotal factors. Efficiency often dictates how much power the hardware consumes for its output. Miners are not just buying hardware; they need to assess the impact on electricity costs. For instance, a miner that operates at lower wattage with a high hash rate can lead to better returns. However, one must also consider the price differences among models. Higher efficiency often accompanies higher initial expenditures, which may not sit well with every budget.

Hash rate is another crucial metric. It measures the processing power of the ASIC miner. A higher hash rate can boost the chances of earning rewards. However, with increased power usually come overheating risks. Thermal management becomes an important concern. Miners must reflect on how they will cool their hardware, especially in larger setups. Finding the balance between hash rate and cooling solutions can be tricky.

Many miners overlook the long-term perspective. It's vital to think beyond initial investment and efficiency ratings. Hardware can become obsolete quickly. Future-proofing one's operation might necessitate additional spending. Evaluating the network's trends and potential changes is wise. This helps in choosing a miner that will not just serve today's needs but also adapt over time.

| Model | Hash Rate (TH/s) | Power Consumption (W) | Efficiency (J/TH) | ROI Period (Months) |

|---|---|---|---|---|

| Model A | 110 TH/s | 3250 W | 29.5 J/TH | 6 |

| Model B | 100 TH/s | 2800 W | 28 J/TH | 7 |

| Model C | 90 TH/s | 2200 W | 24.4 J/TH | 8 |

| Model D | 85 TH/s | 2050 W | 24.2 J/TH | 9 |

| Model E | 80 TH/s | 2100 W | 26.3 J/TH | 10 |

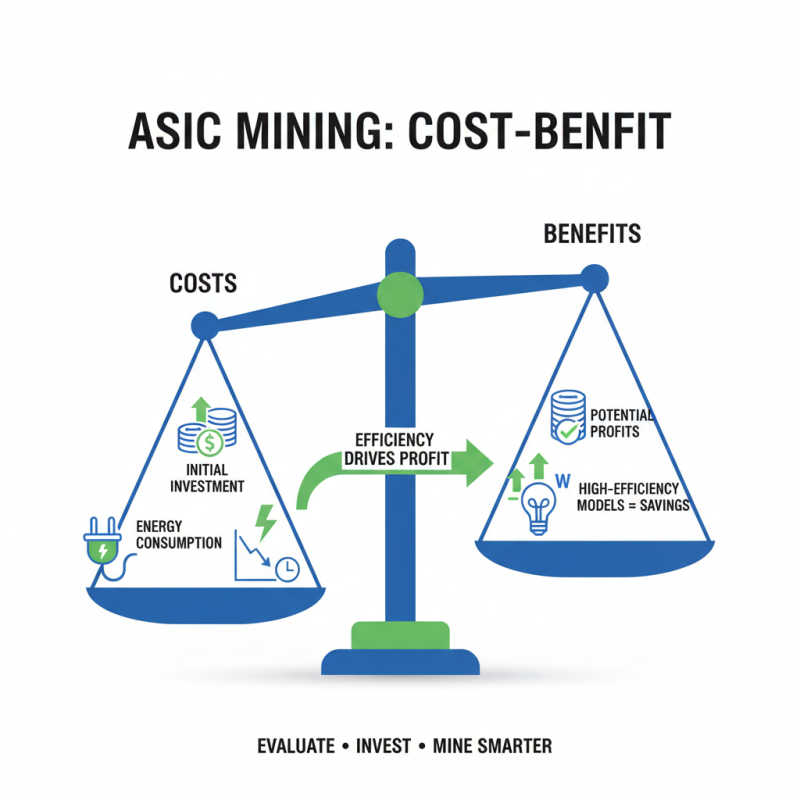

When considering ASIC mining, evaluating the cost-benefit analysis is crucial. ASIC miners require a significant initial investment. Yet, potential returns can vary widely. Energy consumption is a major factor that drives costs. The efficiency of an ASIC miner directly impacts your electricity bills. High-performance models might offset their higher price with energy savings.

One must also analyze the Bitcoin halving events and market conditions. These factors can influence cryptocurrency prices, impacting your return on investment. Assessing mining difficulty is essential too. A rising difficulty means lower rewards. Not every miner will yield profits. You may find some models underperforming, leaving owners disappointed.

Keeping an eye on maintenance and operating costs is also necessary. Equipment longevity can pose risks. Regularly assessing your setup's output may highlight inefficiencies. It’s vital to remain flexible. The crypto market changes swiftly. What works today might not yield the same results tomorrow. Reflecting on these insights can help make better decisions for your mining journey.

The world of ASIC mining is evolving rapidly. As cryptocurrency continues to gain traction, the demand for more efficient and powerful mining hardware grows. Future trends indicate a focus on energy efficiency and advanced manufacturing technologies. Miners will likely seek out ASICs that balance price, power consumption, and hash rate. This balance is crucial in a market where electricity costs are a significant concern.

Tips for choosing an ASIC miner: Look for models with the latest chips. These usually offer better efficiency. Pay attention to cooling solutions as well. Overheating can reduce performance and lifespan. A miner's adaptability to different cryptocurrencies is also worth considering. This flexibility might prove essential in a volatile market.

As the technology evolves, ASIC miners might need to adapt more quickly. Emerging coins could render older models obsolete. Miners should be cautious. Investing in outdated technology can lead to financial losses. Regularly researching market trends can help miners make informed decisions. Understanding future market demands is as important as choosing the right hardware today.

This chart compares the hash rates and power consumption of different ASIC miners, reflecting their efficiency in cryptocurrency mining. Higher hash rates and lower power consumption are indicative of better performance, which is crucial for meeting current market demands.