Leave Your Message

As cryptocurrency continues to dominate discussions in finance and technology, the choice of the right crypto miner has become crucial for those seeking maximum profitability in 2023. According to a recent report by Cambridge Centre for Alternative Finance, Bitcoin mining energy consumption reached an estimated 130 TWh annually, prompting miners to seek more efficient and powerful equipment to sustain their operations. In a rapidly evolving market where hardware performance and energy efficiency directly influence profitability, selecting the best crypto miner has never been more important. With mining profitability fluctuating based on various factors such as electricity costs, difficulty rates, and market prices, making an informed decision can significantly impact returns on investment. Therefore, understanding the nuances of different mining hardware and their capabilities can empower both newcomers and seasoned miners to optimize their strategies in this competitive landscape.

In the rapidly evolving landscape of crypto mining, understanding key profitability metrics is crucial for miners aiming to maximize their returns. One of the primary factors to consider is the hash rate, which reflects the computational power used in mining. A higher hash rate typically correlates with a greater chance of successfully mining blocks and earning rewards. However, it’s essential to balance this against the energy consumption associated with higher hash rates, as electricity costs constitute a significant portion of mining expenses. Reports indicate that the average electricity cost for crypto mining can vary widely, ranging from $0.05 to $0.20 per kWh, impacting overall profitability.

Another critical metric is the difficulty level, which adjusts every two weeks based on the total network hash rate. As more miners join the network, the difficulty increases, potentially reducing individual miners' profitability. Additionally, evaluating mining pools can provide insights into fee structures and payout systems. Joining a reputable mining pool not only enhances the likelihood of consistent payouts but also allows miners to share resources and minimize the risks associated with fluctuating network conditions. Industry analyses suggest that proper selection of mining strategies, including the choice between solo mining and pooling, is essential for optimizing profit margins in 2023.

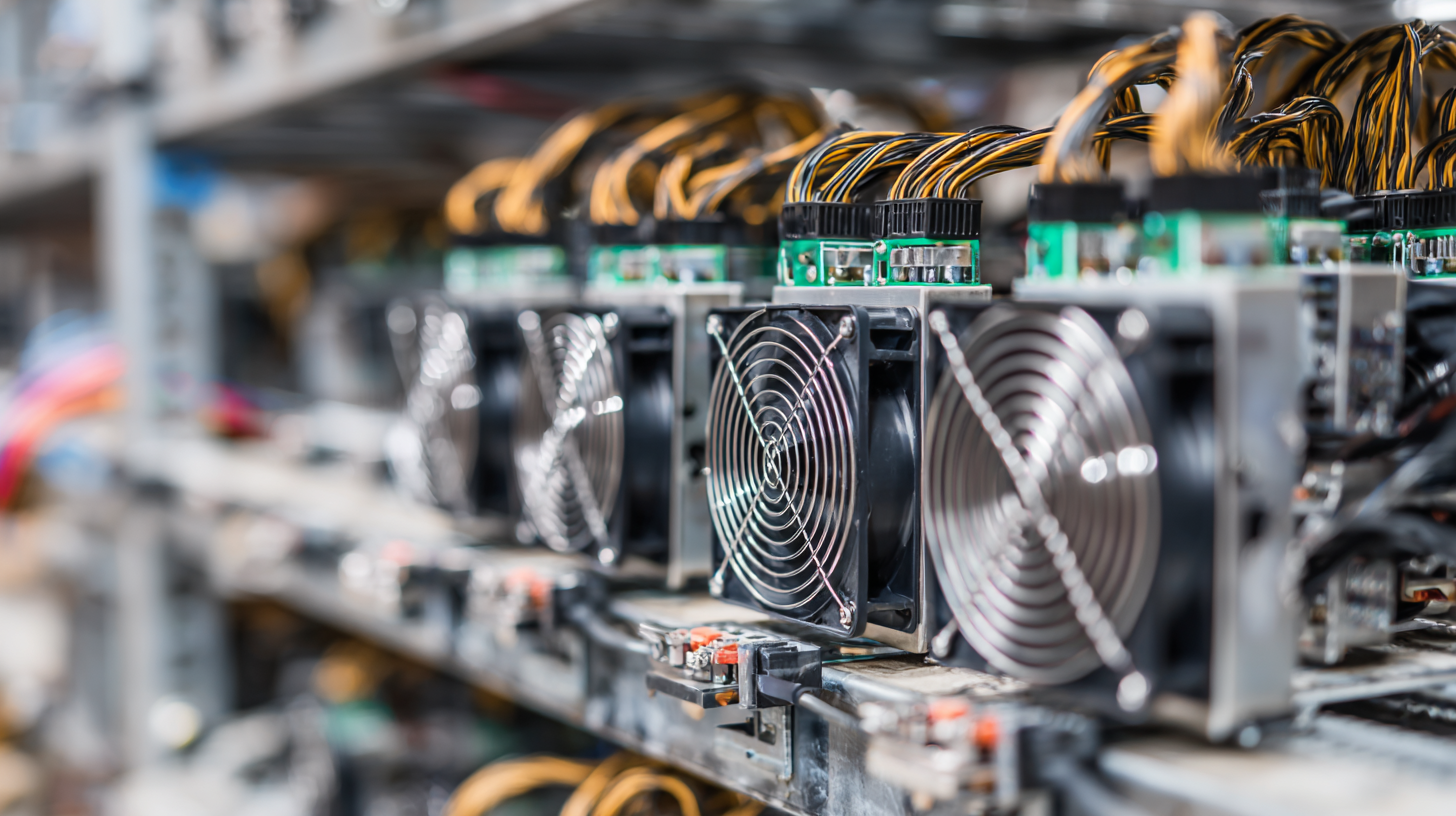

In 2023, choosing the best crypto miner requires a thorough evaluation of the different types available on the market today. The three primary categories include ASIC miners, GPU miners, and FPGA miners. ASIC (Application-Specific Integrated Circuit) miners are specialized machines designed for specific cryptocurrencies, offering the highest hash rates and energy efficiency. For instance, the Bitmain Antminer S19 Pro can reach up to 110 TH/s while consuming around 3250W, making it a top choice for Bitcoin mining. According to a recent report by CoinMetrics, ASIC miners account for over 85% of the Bitcoin hash rate, underscoring their dominance in the mining sector.

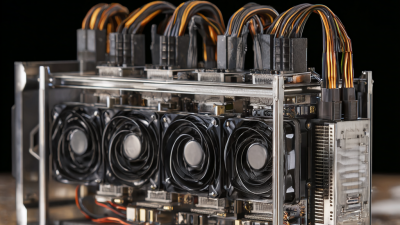

On the other hand, GPU miners, which leverage graphics processing units, provide versatility as they can mine various cryptocurrencies. They are particularly appealing to hobbyists and miners looking to diversify their portfolios. A statistic from Mining Pool Hub indicates that systems using NVIDIA RTX 3080 GPUs can generate around $150 monthly when mining Ethereum. Meanwhile, FPGA miners, which combine the efficiency of ASICs with the flexibility of GPUs, are gaining traction for specific applications due to their adaptability and lower power consumption. According to a report by BitOoda, FPGA miners can provide up to 30% better energy efficiency compared to traditional ASIC miners, making them an attractive alternative for eco-conscious miners.

When selecting a crypto miner for optimal profitability, understanding power consumption is crucial. Power consumption directly affects the operational costs, which in turn influences overall profitability. Different miners have varying power efficiencies, measured in watts per hash rate. A miner that offers a high hash rate but consumes excessive power may not yield the best returns compared to a more efficient model. Therefore, prospective miners must evaluate the energy efficiency of devices they are considering, ensuring that the potential earnings outweigh the electricity costs incurred.

In 2023, with rising energy prices and increasing competition in the crypto market, it’s essential to perform a thorough cost-benefit analysis. Calculate the total energy consumption in kilowatt-hours (kWh) and multiply that by your local energy rates to determine the monthly electricity cost. Compare this with the projected earnings based on the current cryptocurrency values and mining difficulty. This detailed assessment will help you identify the miners that not only deliver high performance but also maximize profitability by minimizing energy expenses.

Staying informed about technological advancements and trends in the mining industry will further assist in making a more informed decision.

In 2023, understanding cryptocurrency market trends is crucial for selecting the best crypto miner to ensure maximum profitability. The recent analysis of Bitcoin adoption revealed significant variations across global regions, highlighting a price elasticity of demand (PED) that fluctuates based on local factors. This underscores the importance of regional research when choosing mining investments, as local adoption rates and price performance can directly impact profitability.

Additionally, as cryptocurrencies continue to grapple with challenges such as regulatory scrutiny and market volatility, the sentiment around their reliability remains cautious. A survey indicated that a majority of Americans lack confidence in the safety of cryptocurrencies, which could affect investment decisions and adoption rates. Therefore, potential miners should monitor both the macro trends in crypto confidence and specific pivotal developments, like central bank digital currencies (CBDCs), which may redefine the landscape and user behavior in the coming years. Keeping an eye on these dynamics will be essential for making informed mining choices in an unpredictable market.

When choosing the best crypto miner for maximum profitability in 2023, understanding hardware and software compatibility is crucial. Specialized mining hardware, such as ASIC miners, is essential for efficient Bitcoin mining. The right combination of hardware and software ensures optimal performance. In 2025, reports indicate that mining profitability hinges on selecting the right software that complements your hardware capabilities. Popular mining software options include both GPU and ASIC-driven platforms, each offering unique advantages tailored to different mining setups.

Tips for maximizing your mining profitability include regularly updating your mining software to benefit from performance improvements and new features. Moreover, it's vital to ensure that your hardware specifications meet the requirements of your chosen software to avoid inefficiencies. Another key strategy is to join mining pools, as they can offer better chances at consistent rewards, especially in highly competitive environments.

Additionally, consider the electrical consumption and cooling requirements of your mining setup. Efficient energy usage not only contributes to better profitability but also prolongs the lifespan of your hardware. Monitoring tools that track performance metrics are invaluable for making real-time adjustments and optimizing your mining operations, ultimately leading to a more profitable endeavor in the ever-evolving crypto market.