Leave Your Message

Choosing the best ASIC miner is vital for maximizing your profits in the cryptocurrency mining industry. According to expert miner Sarah Johnson, "The right ASIC miner can make or break your investment." With so many options available, it can be overwhelming to navigate.

When selecting an ASIC miner, consider factors like hash rate, power consumption, and price. Some miners promise high efficiency, but reality often falls short. Many investors overlook potential long-term costs, like electricity bills, leading to losses.

The market is unpredictable, and making decisions based solely on current trends can be risky. Reflect on your mining goals and budget. Not every ASIC miner will suit everyone, so understand your specific needs. Embrace the challenges, and stay informed to find the best fit for your strategy.

ASIC miners are specialized devices designed for cryptocurrency mining. Unlike general-purpose computers, they are tailored for one specific task—solving complex hashing algorithms. This makes them highly efficient. Their efficiency translates to better profit margins in mining operations.

Understanding how these miners work is crucial. They operate by performing millions of operations per second, significantly faster than traditional CPUs or GPUs. However, efficiency isn’t the only factor to consider. Power consumption is another critical aspect. ASIC miners often consume a lot of electricity, which can eat into profits. It's vital to evaluate electricity costs before making a decision.

While ASIC miners offer high performance, they can be expensive. The initial investment might deter some individuals. Furthermore, their lifespan is often tied to the difficulty of mining. As more people join the network, this difficulty increases, potentially leading to reduced profitability over time. Always conduct thorough research to assess whether an ASIC miner aligns with your financial goals.

Choosing the right ASIC miner is crucial for maximizing profit. One of the key factors to consider is the miner's hash rate. A higher hash rate means more computational power. This can lead to more successful mining attempts. However, a powerful miner can also consume more electricity. You need to evaluate the balance between hash rate and energy efficiency.

Cooling solutions are another important aspect. ASIC miners generate a lot of heat. Effective cooling can prolong the miner's lifespan. Look for models with built-in cooling systems. You might also need additional fans. Keep in mind the noise level, as some miners can be quite loud.

Don't forget about the initial investment cost. ASIC miners can vary significantly in price. A cheaper miner might not give you the best results. Assess your budget and financial goals. It’s also worth researching future scalability. Will the miner accommodate potential upgrades? Reflect on these factors before making your choice. Even a small oversight can impact profitability.

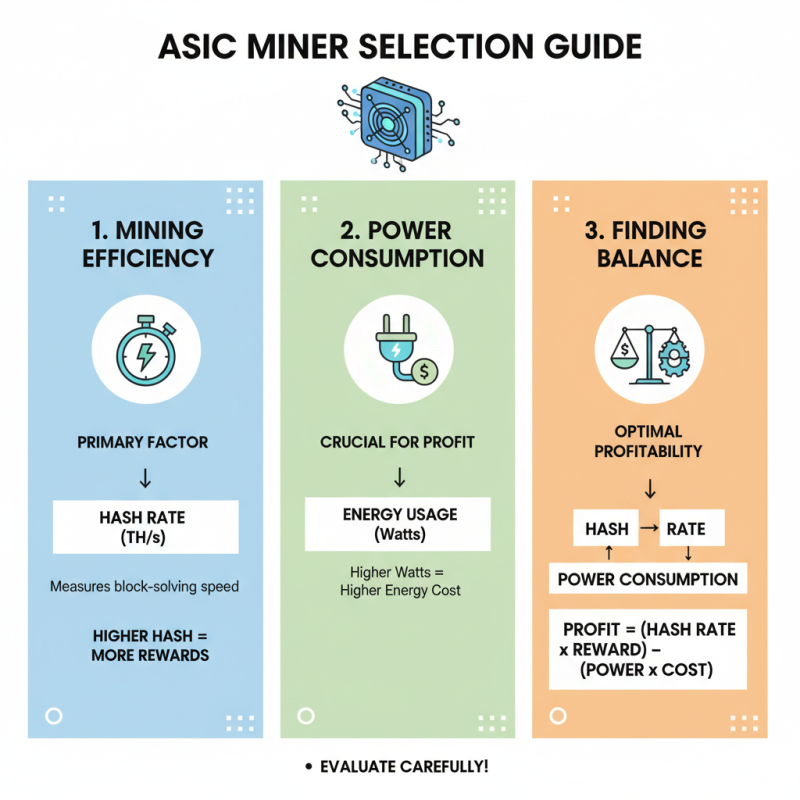

When selecting an ASIC miner, consider mining efficiency as a primary factor. The hash rate measures how quickly the miner can solve blocks. A higher hash rate can lead to more frequent rewards. However, high performance comes at a cost. Power consumption is crucial, as it impacts your overall profitability. Miners with high hash rates often consume more energy, which can eat into your profits. Evaluate this balance carefully.

You might find a miner that offers a competitive hash rate. But ask yourself, is it energy-efficient? Sometimes, a miner with a slightly lower hash rate can save you more on electricity bills. Analyze your energy costs and potential gains. Energy prices vary from region to region. What seems profitable in one area might not be in another. User reviews often highlight the real-world performance of these machines. Though not always accurate, they can offer insight into hidden issues.

Don’t overlook the cooling needs for your setup. Excess heat can lower efficiency and lead to higher electric bills. Also, thermal management can be an overlooked factor. Miners may perform better if kept at optimal temperatures. Set aside a budget for cooling systems as well. Balancing hash rate and power consumption requires ongoing reflection. Be ready to adjust your strategy as technology evolves.

When selecting an ASIC miner, assessing cost versus profitability is critical. Initial investment plays a key role in determining your ROI. Recent reports indicate that the average ASIC miner costs between $2,000 and $10,000. This upfront cost may be burdensome, but it is essential for long-term profitability.

Calculating ROI can be complex. Generally, miners seek to determine the break-even point. A 2023 industry report shows that the average payback period for ASIC miners ranges from 6 to 12 months. Factors influencing this include electricity costs, current cryptocurrency market value, and miner efficiency. High electricity rates can significantly eat into profits, leaving some miners questioning their investments.

The cryptocurrency market is volatile. Profitability may fluctuate weekly. A miner may earn substantial returns one month and face losses the next. It is essential to analyze trends and adjust strategies accordingly. Some may overlook the importance of maintenance costs, which can accumulate over time. A careful assessment of these factors is crucial for making informed investment decisions.

When choosing an ASIC miner, understanding features and performance metrics is crucial. A miner's hashing power determines its potential profitability. High hashing power means faster cryptocurrency validation, leading to better rewards. Heat output and energy consumption are equally important. Miners generate heat, which requires efficient cooling solutions. Your choice should consider the balance of power efficiency and cooling needs.

Tips: Always check the miner's hash rate versus its power consumption. Look for miners that perform well under different temperatures. This can save costs on cooling.

Another aspect to consider is the miner's durability. Some miners may overheat or fail under continuous operation. Be aware of the warranty and manufacturer support. Not all brands provide reliable after-sales services. Performance can differ significantly between models, even from well-known manufacturers.

Tips: Research user reviews and forums about long-term performance. This can guide your decision for better reliability. An initial high cost may not guarantee long-term profitability.