Leave Your Message

In the ever-evolving world of cryptocurrency, selecting the right Bitcoin miner is crucial for maximizing your mining success. With an array of options available, from various brands to different types of mining hardware, making an informed decision can be overwhelming. This ultimate checklist is designed to guide you through the essential factors to consider when choosing a Bitcoin miner that aligns with your goals and budget. Whether you are a seasoned miner or just starting out, understanding the key specifications, efficiency ratios, and potential profitability will empower you to make a choice that enhances your mining operations. With this comprehensive tutorial at your disposal, you can navigate the intricate landscape of Bitcoin mining and set yourself on a path to success.

Understanding Bitcoin mining is essential for anyone looking to invest in this revolutionary technology. At its core, Bitcoin mining involves validating transactions on the blockchain and adding them to the public ledger. Miners use powerful hardware to solve complex mathematical problems, and in return, they earn Bitcoin as a reward. Key concepts include hashing, which is the process of converting transaction information into a fixed-length string, and proof of work, which ensures that miners dedicate computational resources to secure the network.

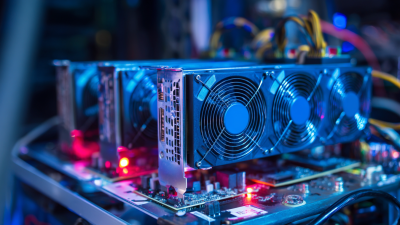

When choosing the right hardware for mining, keep in mind the importance of efficiency and power consumption. Look for ASIC miners, as these are specifically designed for Bitcoin mining and offer superior performance compared to general-purpose hardware. Additionally, consider joining a mining pool to combine your resources with others, enhancing your chances of earning rewards more consistently. Engaging in proper research and understanding the market trends can greatly influence your success in mining.

Lastly, stay updated with the latest mining software and tools. Regular updates can provide improved algorithms and increased security features, which are crucial in this evolving landscape. Understanding the terminology associated with mining will help you navigate forums and educational resources effectively, empowering you to make informed decisions that maximize your mining success.

When delving into the world of Bitcoin mining, one of the pivotal decisions you'll face is choosing between ASIC and GPU miners. ASIC (Application-Specific Integrated Circuit) miners are designed specifically for the purpose of mining cryptocurrencies. Their specialized hardware allows them to achieve exceptional hashing power and energy efficiency, making them the go-to choice for serious miners who aim for profitability and high performance. However, this specialized nature means that ASIC miners are often more expensive and can only mine specific coins, limiting flexibility.

On the other hand, GPU (Graphics Processing Unit) miners boast versatility, allowing users to mine a wider range of cryptocurrencies beyond Bitcoin. While they generally offer lower hashing power compared to ASIC miners, GPUs have become popular due to their ability to be utilized for gaming and other tasks when not mining. This multifaceted use makes them an appealing option for hobbyists and those new to the mining scene. Ultimately, the choice between ASIC and GPU miners will depend on your specific goals, budget, and whether you prioritize efficiency or versatility in your mining endeavors.

| Parameter | ASIC Miner | GPU Miner |

|---|---|---|

| Hash Rate | Over 100 TH/s | 10-40 MH/s |

| Power Consumption | Around 3000 W | 150-300 W |

| Initial Cost | $2000+ | $500-$1500 |

| Mining Efficiency | High | Moderate |

| Cooling Needs | Requires specialized cooling | Standard PC cooling |

| Return on Investment | Faster | Slower |

| Flexibility | Limited | High |

When selecting the right Bitcoin miner, two critical aspects to consider are

hash rate and unit efficiency. The hash rate, measured in

hashes per second (H/s), reflects the processing power of the miner. A higher hash rate increases

the chances of solving complex mathematical problems faster, enabling miners to validate transactions and earn

rewards more effectively. Therefore, understanding the hash rate specifications of potential mining devices is

essential for maximizing mining performance.

When selecting the right Bitcoin miner, two critical aspects to consider are

hash rate and unit efficiency. The hash rate, measured in

hashes per second (H/s), reflects the processing power of the miner. A higher hash rate increases

the chances of solving complex mathematical problems faster, enabling miners to validate transactions and earn

rewards more effectively. Therefore, understanding the hash rate specifications of potential mining devices is

essential for maximizing mining performance.

In addition to the hash rate, unit efficiency plays a vital role in determining the overall profitability of your mining operation. Unit efficiency, usually expressed in joules per terahash (J/TH), indicates how much energy the miner consumes to produce one terahash. Choosing a miner with lower energy consumption not only helps reduce electricity costs but also enhances sustainability in your mining activities. Balancing these two factors— hash rate and unit efficiency—will ensure that you invest in equipment capable of delivering optimal performance while minimizing operational expenses. This careful assessment lays a strong foundation for successful Bitcoin mining endeavors.

When selecting the right Bitcoin miner, understanding power consumption and cooling solutions is vital for maximizing efficiency and profitability. A miner's power efficiency directly affects its running costs; hence, opting for devices with lower wattage can significantly reduce expenses. Look for miners that provide a high hash rate relative to their power consumption. This balance not only ensures better performance but can also lead to better returns on investment.

When selecting the right Bitcoin miner, understanding power consumption and cooling solutions is vital for maximizing efficiency and profitability. A miner's power efficiency directly affects its running costs; hence, opting for devices with lower wattage can significantly reduce expenses. Look for miners that provide a high hash rate relative to their power consumption. This balance not only ensures better performance but can also lead to better returns on investment.

In addition to power consumption, effective cooling solutions are crucial for maintaining optimal performance. Overheating can lead to hardware failure or reduced efficiency, so investing in robust cooling systems, such as air or liquid cooling, can prolong the lifespan of your miner. Consider setting up your mining rigs in a well-ventilated area or using dedicated cooling units to manage heat effectively.

Tip: Regularly monitor the temperature of your miners and consider using temperature sensors for real-time data. This proactive approach will help you adjust cooling solutions promptly, ensuring that your mining operation runs smoothly and efficiently.

When diving into Bitcoin mining, a crucial aspect for aspiring miners is budgeting effectively for their setup. According to the Cambridge Centre for Alternative Finance, as of 2023, the average cost of a high-performance Bitcoin miner can range from $6,000 to $12,000, depending on the model and its hashing power. Optimizing your budget involves not only accounting for the initial cost of the mining hardware but also considering other expenses such as electricity, cooling systems, and potential maintenance costs.

Electricity plays a significant role in a miner's overall expenditure. A report from the International Energy Agency indicates that the average Bitcoin miner consumes about 1,500 kWh each month. In regions where electricity costs vary, this can lead to monthly expenses ranging from $60 to over $300. Therefore, understanding local electricity rates and finding ways to reduce consumption or utilize renewable energy sources can greatly affect the profitability of your mining operation. By carefully analyzing these costs and planning accordingly, miners can set themselves up for greater success in the competitive world of Bitcoin mining.