Leave Your Message

In the ever-evolving world of cryptocurrency mining, selecting the right equipment is crucial. A Bit Mining Machine plays a vital role in maximizing efficiency and profitability. With numerous options available, miners face the challenge of finding the best fit for their needs. Each machine offers unique specifications and performance metrics that can significantly impact mining outcomes.

Examining these machines reveals both strengths and weaknesses. Some machines promise high hash rates but consume excessive power. Others may be energy-efficient but lack processing power. It is essential to weigh these factors carefully, as mining profitability often hinges on a machine's balance between power and efficiency. Minor details can lead to profound differences in performance.

For many, the journey of choosing a Bit Mining Machine can be daunting. It requires time, research, and often a willingness to experiment. As miners navigate this complex landscape, embracing trial and error can lead to greater insights. Reflection on past decisions is key. It becomes apparent that there is no one-size-fits-all solution, and each miner's circumstances must guide their choices.

Cryptocurrency mining machines are essential for miners aiming to validate transactions and earn rewards. These machines work by solving complex mathematical problems, a process that requires significant computational power. According to recent industry reports, the efficiency of mining machines is measured by their hash rate and energy consumption. A higher hash rate often means more potential rewards, but energy costs can quickly eat into profits.

In 2022, an analysis indicated that mining machines typically consume between 1,200 to 3,500 watts, depending on their power. This translates to considerable electricity costs. Miners need to weigh the upfront investment against long-term energy expenses. Some machines may seem powerful but can drain resources faster than anticipated. Miners should continuously analyze performance metrics and adjust their strategies accordingly.

Moreover, the market is constantly evolving. New technologies emerge, and older models can quickly become obsolete. A report from the Cambridge Centre for Alternative Finance revealed that mining operations are facing increased scrutiny over their environmental impacts. This places additional pressure on miners to adopt more efficient and sustainable practices. As the mining landscape changes, reflection on current setups and future investments is crucial for success.

| Mining Machine Model | Hash Rate (TH/s) | Power Consumption (W) | Efficiency (J/TH) | Price (USD) |

|---|---|---|---|---|

| Model A | 110 | 3400 | 30.91 | 2500 |

| Model B | 100 | 3000 | 30.00 | 2300 |

| Model C | 90 | 2700 | 30.00 | 2100 |

| Model D | 120 | 3600 | 30.00 | 2800 |

When it comes to cryptocurrency mining, efficiency is paramount. Various factors can significantly influence the efficiency of mining hardware. One key factor is hash rate. The hash rate measures how many calculations a mining machine can perform per second. According to industry reports, machines with high hash rates can result in up to 30% more cryptocurrency mined over the same period.

Another crucial element is power consumption. The energy cost directly impacts profitability. Research indicates that the most efficient mining machines use less than 30 Joules per Terahash. However, many miners overlook the long-term costs of electricity in their initial calculations. This often leads to regrets when faced with soaring electricity bills.

Cooling solutions are another aspect that can’t be ignored. Overheating can lead to hardware failure. Effective cooling can extend the lifespan of mining rigs by up to 50%. Yet, not all setups include adequate cooling, and this can be a costly oversight. Miners should invest in proper ventilation to safeguard their equipment. The balance between cost and efficiency is delicate and requires careful thought.

When comparing bit mining machines, efficiency is key. Each model offers different hashing power, energy consumption, and thermal management. Users must weigh these factors carefully before making a decision. Some machines are highly efficient but can be quite noisy. Noise may impact your working environment.

In 2023, many machines have upgraded chips. These chips can significantly improve performance. However, the heat generated needs proper ventilation. Ignoring this can lead to overheating issues and lower efficiency. Besides, machines with lower energy efficiency might seem cheaper but can cost more in the long run.

Cost of electricity varies by region. Thus, a machine that performs well in one area may not be effective elsewhere. Users should perform a detailed cost-benefit analysis. Each mining operation may require different setups. Not all machines will fit every need. This makes personal research crucial.

When evaluating mining machines, performance metrics are crucial. Hash rate significantly defines efficiency. A higher hash rate means more calculations per second. In recent studies, top devices show hash rates ranging from 30 TH/s to over 100 TH/s. These numbers promise impressive returns, but they vary widely.

Energy consumption can’t be ignored. Machines with high hash rates often consume vast amounts of electricity. Reports indicate some miners use up to 1500 watts for optimal performance. This consumption impacts profitability. Miners must calculate the cost of electricity against potential earnings. Efficient machines may pay off in the long run, but initial costs can deter users.

Return on investment (ROI) takes time to assess. Typical ROI spans six months to several years. Factors like market fluctuations and operational costs influence these timelines. Miners often find unexpected hurdles in achieving profitability. Tracking performance metrics closely is essential for successful mining operations. A strategic approach is necessary to navigate this complex landscape.

This chart compares the performance metrics of various hypothetical cryptocurrency mining machines based on their hash rates, energy consumption, and return on investment (ROI).

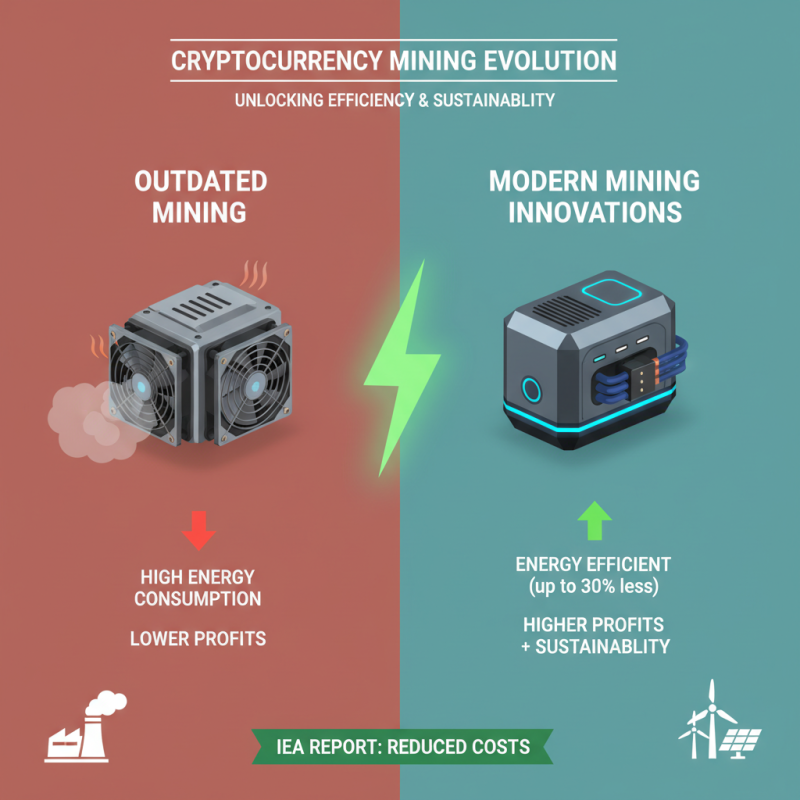

The landscape of cryptocurrency mining is rapidly evolving. Innovations in mining technology promise to enhance efficiency and sustainability. According to a recent report from the International Energy Agency, energy-efficient mining equipment could reduce operational costs by up to 30%. Yet, many miners still rely on outdated machines, missing opportunities for higher profits and lower energy usage.

A key trend is the development of Application Specific Integrated Circuits (ASICs). These devices are tailored for specific tasks, yielding significant performance gains. Research indicates that the latest ASIC miners can achieve hash rates exceeding 100 TH/s, substantially improving mining output. However, the initial investment remains high, creating barriers for newcomers.

Software improvements are also a factor. Enhanced mining algorithms can optimize performance, adapting to network difficulty changes. Yet, many miners overlook software updates, which can lead to missed performance enhancements. As mining becomes more competitive, staying updated is crucial. Without innovation in both hardware and software, miners risk falling behind in an ever-changing market.