Leave Your Message

In the rapidly evolving world of cryptocurrency, mining remains a vital activity. The right tools make a difference. An Asic Miner stands out for its efficiency in mining operations. These machines offer powerful hashing capabilities. They can handle complex algorithms quickly, ensuring better returns. Each model comes with distinct features focusing on performance.

However, choosing the best Asic Miner is not straightforward. Factors like power consumption, cost, and mining difficulty vary significantly. The layout of your mining setup matters too. This creates a saturation point that many overlook. Mistakes in selection can lead to inadequate performance and wasted investment. It requires careful evaluation of your mining goals.

Moreover, the landscape of cryptocurrency is ever-changing. New technologies and updates reshape the market. Buyers must stay informed to make intelligent decisions. Testing models or consulting experts can be beneficial. In the end, the ideal Asic Miner should align with both your needs and market trends. It’s an ongoing journey requiring adaptation and reflection.

ASIC miners have revolutionized cryptocurrency mining. These specialized devices offer superior performance and efficiency compared to traditional mining rigs. According to recent industry reports, ASIC miners account for over 80% of Bitcoin's total network hash rate. This dominance highlights their importance in the mining landscape.

The efficiency of ASIC miners is noteworthy. Many of these devices boast energy efficiencies exceeding 100 J/TH. This efficiency ratio indicates how effectively miners convert electricity into cryptocurrency. However, the initial investment can be significant, often exceeding several thousand dollars. Miners must consider this expense versus potential returns. New entrants sometimes underestimate long-term costs, such as electricity and maintenance.

While ASIC miners deliver impressive results, they are not without challenges. The rapid pace of technology means models can quickly become outdated. Miners may face a dilemma: invest in the latest hardware or keep their current devices running. Additionally, the environmental impact of high energy consumption raises concerns. As the industry evolves, finding a balance between profitability and sustainability is crucial.

When considering the best ASIC miner, focus on key features that impact performance. Hash rate is a top priority. A higher hash rate means more calculations processed per second. This directly affects your mining efficiency. Look for miners that offer a competitive hash rate for the cryptocurrency you intend to mine.

Power consumption is another vital factor. ASIC miners can consume a lot of energy. Therefore, check the wattage and calculate energy costs. Efficient miners save you more money over time. Tips: Always compare the cost-to-efficiency ratio. It can reveal hidden costs that might affect your mining results.

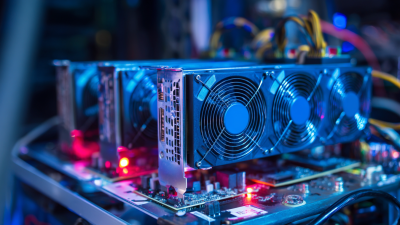

Cooling systems are essential too. ASIC miners produce heat during operations. A good cooling system prolongs the miner's life and improves efficiency. Think about how you will manage heat in your mining setup. Remember, more expensive isn’t always better. Assess if the features align with your goals and budget.

When selecting the best ASIC miner for cryptocurrency, several factors come into play. The efficiency of the miner is crucial. Look for devices that offer a high hash rate while consuming less power. This balance can significantly affect overall profitability. Additionally, consider the cooling requirements. High-performance miners generate a lot of heat, leading to potential operational issues.

Another important aspect is the initial investment cost. Some miners may have a low upfront cost but can lead to higher energy costs. Evaluating the return on investment is essential. Users should also assess the longevity of the equipment. Technology in this space evolves rapidly, making some models obsolete sooner than expected.

A few users reported issues with setup and maintenance. The complexity can deter even seasoned miners. It's important to read user reviews and learning from others’ experiences. Choosing the right miner involves trial and error. Keeping an open mind can lead to better results and more refined decision-making. Consider all these factors when comparing options for 2023.

When evaluating the mining efficiency and profitability of ASIC miners, several key factors emerge. The hash rate measures a miner's performance. A high hash rate translates to better coin generation. Recent reports suggest that ASIC miners have hash rates exceeding 100 TH/s. This number is essential for a miner's output, but efficiency is equally crucial. Many models operate at different power consumptions. The energy usage can exceed 3000 watts. This considerable power requirement can significantly cut into profits.

Return on investment (ROI) remains a vital aspect. Reports indicate that miners often see ROI within 6-12 months, depending on market conditions. However, fluctuating cryptocurrency prices can impact this timeline. Market volatility creates uncertainty. A miner may need to adjust strategies based on current trends.

Additionally, the lifespan of the hardware must be considered. ASIC miners generally have a limited operational life. After a few years, performance may diminish as newer models emerge. Maintenance costs can also accumulate over time.

Understanding the balance between initial investment and operational costs is essential. Efficiency is not just about raw power; it also involves smart resource management. Some miners face difficulties optimizing their setups. Not every ASIC miner achieves optimal results without careful planning. Long-term success requires ongoing evaluation. What works well today may not hold the same value tomorrow.

The future of ASIC mining technology is rapidly evolving. Miners seek higher efficiency and lower energy consumption. New algorithms may emerge that challenge the current standards. These advancements could redefine profitability in the industry.

Market dynamics are also shifting. Regulatory changes influence miner operations. A surge in demand for sustainable energy sources is evident. As environmental concerns grow, miners must adapt to these changes. Some may struggle to remain competitive due to rising costs and technical limitations.

While innovation drives success, there are challenges. Not all miners can invest in the latest technology. Smaller operations may find it difficult to scale. As the landscape changes, reflection on strategy and adaptability becomes crucial. The market rewards those who can pivot.

Miners must stay informed about trends to ensure longevity in this competitive space.