Leave Your Message

The cryptocurrency mining landscape is rapidly evolving. As of 2023, the global crypto miner market is projected to reach over $1 billion. This growth highlights significant opportunities for miners aiming to capitalize on rising demands. Mining profitability often hinges on technology, efficiency, and market conditions.

Recent data indicates that energy costs account for a large portion of mining expenses. Miners must choose equipment that balances power consumption and hash rate effectively. For instance, ASIC miners have become popular due to their enhanced performance compared to traditional miners. However, the initial investment remains substantial.

Investors should be cautious. Not every crypto miner can guarantee steady returns. Market volatility and regulatory changes can impact mining fortunes abruptly. As reported by industry experts, mining rewards can fluctuate significantly. Miners must adapt their strategies continually to stay profitable. This dynamic environment demands both informed decision-making and constant reflection on operational efficiency.

When selecting a crypto miner, several key factors play a crucial role. One important consideration is the miner's efficiency. High-efficiency miners save energy and yield better profits. Look for miners with low power consumption and high hash rates. This will determine your potential earnings over time.

Another factor to evaluate is the miner’s cooling system. Proper cooling reduces overheating and extends the lifespan of the equipment. Miners that run too hot can lead to failures and costly repairs. It’s wise to consider how you will manage the heat generated by your setup.

Tips: Always read user reviews before making a decision. Real user experiences can provide insights on performance and reliability. Also, don't rush into buying the latest model. Sometimes, older models can deliver impressive results at a lower cost. Reflect on your specific needs and budget to ensure a suitable choice.

As the crypto market evolves, mining hardware remains crucial for profitability. In 2026, various miners make headlines. They boast different specifications, affecting performance and energy efficiency. The latest models feature enhanced hash rates, often exceeding prior generations. Miners need to examine power consumption closely. High efficiency can mean lower energy costs and better returns.

Several mining rigs run on cutting-edge technology, improving operations significantly. Some miners stand out due to their cooling solutions. Keeping hardware cool is vital for longevity and performance. However, not all cooling technologies are equally effective. Some may require tweaks after purchase.

While evaluating hardware, consider the initial costs versus potential earnings. Prices can fluctuate wildly. It’s essential to analyze market trends and miner reviews. Not every miner listed as "best" turns out to be the most profitable in practice. Mining is not always a straightforward path to success. Users must adapt strategies as technology and market conditions change.

When assessing crypto mining profitability, several key performance metrics come into play. Hash rate is crucial. It indicates a miner's processing power. Higher hash rates usually lead to better chances of mining successfully. However, this metric alone does not ensure profits.

Energy efficiency is another vital factor. Miners must consider power consumption. A miner that uses excessive energy will eat into profits. Thus, tracking energy costs is essential. It's not just about the hardware but how much it costs to run it. Often, miners overlook these costs until it’s too late.

Lastly, network difficulty is a significant element. As more miners join, difficulty rises. This can impact profitability directly. New miners may find it challenging to compete. It's important to analyze these metrics regularly. Ignoring them can lead to unprofitable ventures. Balancing performance and costs requires continuous reflection and adjustment.

| Hash Rate (TH/s) | Power Consumption (W) | Efficiency (J/TH) | Estimated Earnings per Day ($) | Payback Period (months) |

|---|---|---|---|---|

| 120 | 3500 | 29.17 | 10.50 | 10 |

| 140 | 3600 | 25.71 | 12.00 | 8 |

| 100 | 3200 | 32.00 | 9.00 | 11 |

| 160 | 4000 | 25.00 | 15.00 | 6 |

| 180 | 4500 | 25.00 | 16.50 | 5 |

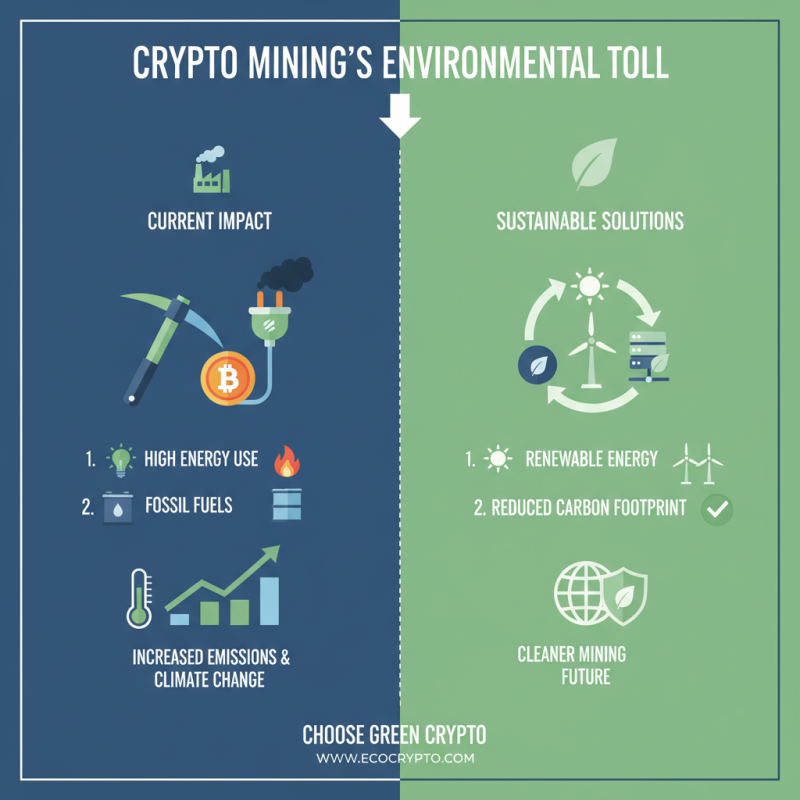

The environmental impact of crypto mining is significant. Many miners rely on fossil fuels for energy. This increases greenhouse gas emissions. The high energy consumption of mining operations contributes to climate change. It's crucial to consider renewable energy sources in mining practices. Solar and wind energy can power mining rigs more sustainably.

However, the shift to greener solutions presents challenges. Infrastructure for renewable energy might not be available everywhere. In some regions, it’s still cost-prohibitive. Miners often face higher costs for greener energy options. This can lead to a trade-off between profitability and sustainability.

Additionally, e-waste from outdated mining equipment is a growing concern. Many miners discard their hardware too quickly. This creates waste and environmental hazards. Responsible disposal or recycling of equipment is essential. Finding a balance between profit and environmental impact is a continuous struggle for miners.

The future of crypto mining technologies is rapidly evolving. Innovations are emerging, promising higher efficiency and lower energy consumption. Miners are constantly seeking better methods to increase their profitability. As green energy sources become more accessible, the focus will shift towards eco-friendly solutions. This trend reflects a growing awareness of environmental impacts.

Tips: Embrace renewable energy. It can reduce costs and improve sustainability. Consider investing in solar panels or wind energy to power mining rigs.

New algorithms are being developed to optimize mining processes. These improvements can enhance the speed and capability of miners. However, not every innovation guarantees success. Some may require significant investment upfront. Miners should clearly evaluate the risk versus reward before committing.

Tips: Stay updated with industry news. Join crypto forums to learn from others’ experiences. This can help avoid common pitfalls.

Adopting the latest technologies may seem daunting. Experimentation is vital in finding what works best. Each miner’s situation is unique, and adaptability can lead to greater profits.